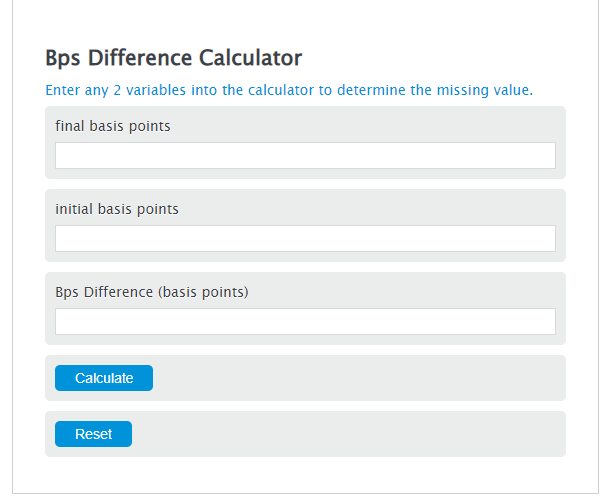

Enter the final basis points and the initial basis points into the Calculator. The calculator will evaluate the Bps Difference.

- Basis Points Increase Calculator

- Basis Point To Percentage Calculator

- PVBP – Price Value Basis Point Calculator

Bps Difference Formula

BPSD = BPSf - BPSi

Variables:

- BPSD is the Bps Difference (basis points)

- BPFSf is the final basis points

- BPSi is the initial basis points

To calculate Bps Difference, subtract the initial basis points from the final basis points value.

How to Calculate Bps Difference?

The following steps outline how to calculate the Bps Difference.

- First, determine the final basis points.

- Next, determine the initial basis points.

- Next, gather the formula from above = BPSD = BPSf – BPSi.

- Finally, calculate the Bps Difference.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

final basis points = 50

initial basis points = 30

FAQs

What are basis points and how are they used in finance?

Basis points (bps) are a unit of measure used in finance to describe the percentage change in the value or rate of a financial instrument. One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form. They are commonly used to indicate changes in interest rates, bond yields, and the rates of return on investments.

Why do financial professionals use basis points?

Financial professionals use basis points because they provide a clear and precise way to discuss small changes in financial rates and percentages. Using basis points can help avoid confusion that might arise from discussing percentages in terms of fractions or decimals. This precision is crucial for accurately conveying information in financial markets and analysis.

Can the Bps Difference be negative, and what does it signify?

Yes, the Bps Difference can be negative. A negative Bps Difference indicates that the final basis points are lower than the initial basis points. This could signify a decrease in interest rates, a drop in bond yields, or a decline in the rate of return on an investment over the period in question.

How can calculating the Bps Difference help investors?

Calculating the Bps Difference can help investors understand the magnitude of change in the interest rates, yields, or returns on investments over a period. This understanding can aid in making informed decisions about buying, selling, or holding financial instruments. It helps investors gauge the market’s direction and the potential impact on their portfolios.