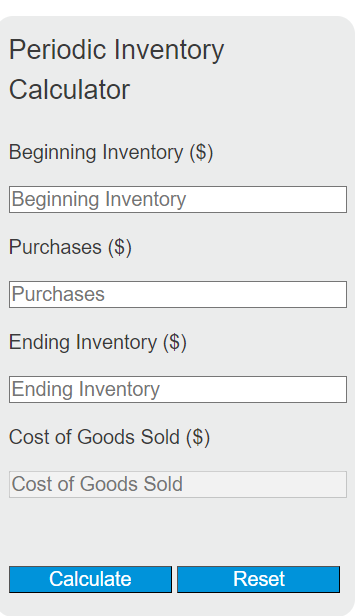

Enter the beginning inventory, purchases, and ending inventory into the calculator to determine the cost of goods sold. This calculator is useful for businesses using the periodic inventory system.

Periodic Inventory Formula

The following formula is used to calculate the cost of goods sold (COGS) in a periodic inventory system:

COGS = BI + P - EI

Variables:

- COGS is the cost of goods sold

- BI is the beginning inventory

- P is the total purchases during the period

- EI is the ending inventory

To calculate the cost of goods sold, add the beginning inventory to the purchases made during the period and then subtract the ending inventory.

What is Periodic Inventory?

Periodic inventory is an accounting method where the inventory value and cost of goods sold are determined at the end of an accounting period. It contrasts with the perpetual inventory system, where inventory and cost of goods sold are updated continuously as transactions occur. The periodic inventory system is often used by smaller businesses due to its simplicity and lower cost of implementation.

How to Calculate Cost of Goods Sold with Periodic Inventory?

The following steps outline how to calculate the cost of goods sold using the periodic inventory system:

- First, determine the beginning inventory at the start of the accounting period.

- Next, determine the total amount of purchases made during the accounting period.

- Then, determine the ending inventory at the end of the accounting period.

- Use the formula COGS = BI + P – EI to calculate the cost of goods sold.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Beginning Inventory (BI) = $5,000

Purchases (P) = $2,000

Ending Inventory (EI) = $1,500