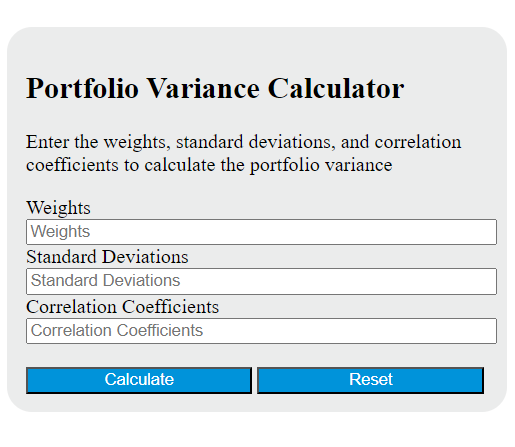

Enter all but one of the weights, standard deviations, and correlation coefficients into the calculator to determine the portfolio variance; this calculator can also evaluate any of the variables given the others are known.

Portfolio Variance Formula

The following formula is used to calculate the portfolio variance:

PV = w1^2 * σ1^2 + w2^2 * σ2^2 + ... + wn^2 * σn^2 + 2 * w1 * w2 * ρ12 * σ1 * σ2 + ... + 2 * w1 * wn * ρ1n * σ1 * σn + ... + 2 * wn-1 * wn * ρn-1n * σn-1 * σn

Variables:

- PV is the portfolio variance

- w1, w2, ..., wn are the weights of the individual assets in the portfolio

- σ1, σ2, ..., σn are the standard deviations of the individual assets

- ρ12, ρ1n, ..., ρn-1n are the correlation coefficients between the individual assets

To calculate the portfolio variance, square the weight of each asset and multiply it by the square of its standard deviation. Then, multiply the product of each pair of weights by the corresponding correlation coefficient and the product of their standard deviations. Finally, sum up all these terms to obtain the portfolio variance.

What is a Portfolio Variance?

Portfolio variance is a measure of the dispersion of returns of a portfolio. It is the aggregate of the actual returns of a given portfolio over a set period of time. Portfolio variance is a key concept in modern portfolio theory, which argues that the risk inherent in an investment should be measured by the variance of its return. It is calculated by multiplying the squared weight of each investment by its corresponding variance and adding two times the weighted average of the securities times their covariance. Portfolio variance is used to determine the volatility, or risk, of the portfolio. A higher portfolio variance indicates a higher degree of risk and volatility, and a lower portfolio variance indicates a lower degree of risk.

How to Calculate Portfolio Variance?

The following steps outline how to calculate the Portfolio Variance.

- First, determine the weights of each asset in the portfolio.

- Next, determine the variances of each asset in the portfolio.

- Next, determine the covariance between each pair of assets in the portfolio.

- Calculate the squared weights of each asset.

- Multiply the squared weights by the variances of each asset.

- Multiply the weights of each pair of assets by their respective covariance.

- Sum up the results from steps 5 and 6.

- The final result is the portfolio variance.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Weights: Asset A = 0.4, Asset B = 0.6

Variances: Asset A = 0.09, Asset B = 0.16

Covariance: Cov(A,B) = 0.04