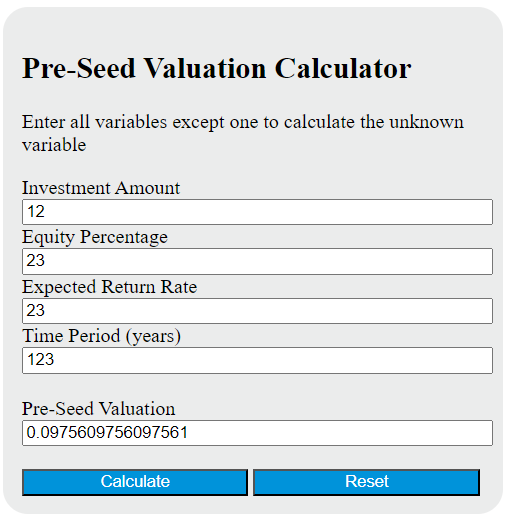

Enter all but one of the investment amount, equity percentage, expected return rate, and time period in years into the calculator to determine the pre-seed valuation. This calculator can also evaluate any of the variables given the others are known.

- Cash Over Valuation Calculator

- Valuation Percentage Calculator

- Company Valuation Based on Revenue Calculator

- Startup Valuation Calculator

Pre-Seed Valuation Formula

The following formula is used to calculate the pre-seed valuation:

V = (I * E) / (R * T)

Variables:

- V is the pre-seed valuation

- I is the investment amount

- E is the equity percentage

- R is the expected return rate

- T is the time period in years

To calculate the pre-seed valuation, multiply the investment amount by the equity percentage, then divide the result by the expected return rate multiplied by the time period in years.

What is a Pre-Seed Valuation?

A pre-seed valuation refers to the estimated worth of a startup company before it begins to receive initial investment funding, also known as seed funding. This valuation is crucial as it helps determine the equity percentage that investors will receive in exchange for their investment. The pre-seed valuation is typically based on several factors, including the startup’s business model, the potential market size, the experience and skills of the founding team, and the uniqueness of the product or service. It’s important to note that at this early stage, the valuation is largely speculative as the company may not yet have a proven track record or substantial revenue. Therefore, the pre-seed valuation is often subject to negotiation between the startup founders and potential investors.