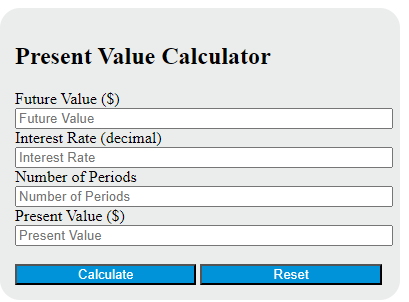

Enter the future value, interest rate, and number of periods into the calculator to determine the present value. This calculator can also evaluate any of the variables given the others are known.

- Portfolio Variance Calculator

- Estimated Recovery Value (ERV) Calculator

- Market to Book Ratio Calculator

Present Day Value Formula

The following formula is used to calculate the present day value.

PV = FV / (1 + r)^n

Variables:

- PV is the present value ($)

- FV is the future value ($)

- r is the interest rate (decimal)

- n is the number of periods

To calculate the present value, divide the future value by the sum of 1 and the interest rate, raised to the power of the number of periods. This will give you the value of an investment or loan in today’s dollars.

What is a Present Day Value?

Present Day Value (PDV), also known as Present Value, is a financial concept that involves calculating the worth of a future amount of money in today’s terms, considering the time value of money. It is based on the principle that a dollar today is worth more than a dollar in the future due to potential earning capacity. This concept is used in finance to compare cash flows that occur at different times, as it discounts future cash flows to the present, taking into account the risk and return associated with the time value of money.

How to Calculate Present Day Value?

The following steps outline how to calculate the Present Day Value (PV) using the formula: PV = FV / (1 + r)^n.

- First, determine the future value (FV) ($).

- Next, determine the interest rate (r) (decimal).

- Next, determine the number of periods (n).

- Next, calculate (1 + r)^n.

- Finally, calculate the Present Day Value (PV) using the formula PV = FV / (1 + r)^n.

- After inserting the variables and calculating the result, check your answer with a calculator.

Example Problem:

Use the following variables as an example problem to test your knowledge:

Future value (FV) ($) = 500

Interest rate (r) (decimal) = 0.05

Number of periods (n) = 3