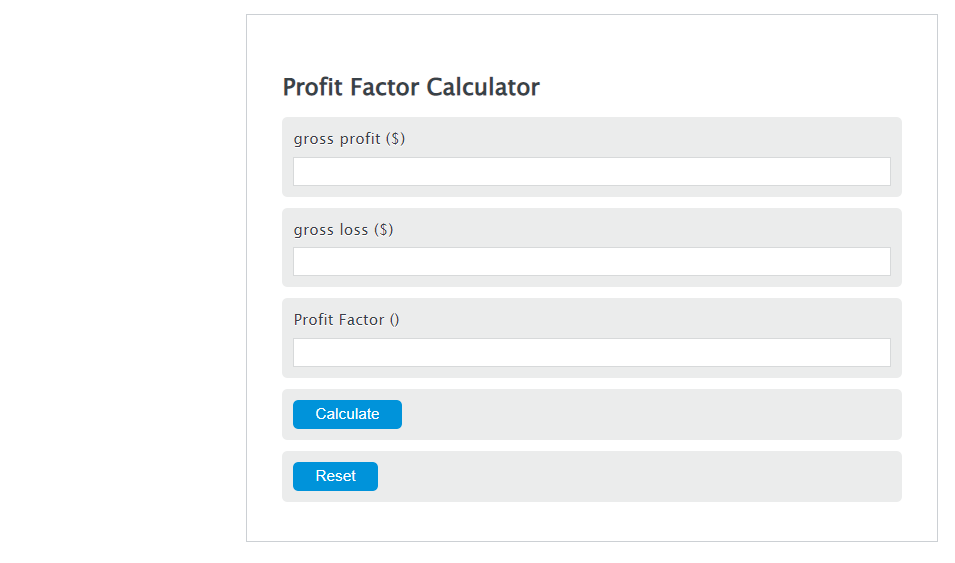

Enter the gross profit ($) and the gross loss ($) into the Calculator. The calculator will evaluate the Profit Factor.

Profit Factor Formula

PF = GP / GL

Variables:

- PF is the Profit Factor ()

- GP is the gross profit ($)

- GL is the gross loss ($)

To calculate the Profit Factor, divide the gross profit by the gross loss.

How to Calculate Profit Factor?

The following steps outline how to calculate the Profit Factor.

- First, determine the gross profit ($).

- Next, determine the gross loss ($).

- Next, gather the formula from above = PF = GP / GL.

- Finally, calculate the Profit Factor.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

gross profit ($) = 30

gross loss ($) = 50

Frequently Asked Questions

What is the significance of calculating the Profit Factor?

The Profit Factor is a crucial metric for understanding the profitability of a business or investment by comparing the gross profits to the gross losses. It helps in evaluating the efficiency and sustainability of generating profits over losses.

Can the Profit Factor be less than 1, and what does it indicate?

Yes, the Profit Factor can be less than 1. A Profit Factor less than 1 indicates that the losses exceed the profits, suggesting that the business or investment is not currently profitable and may need strategic adjustments.

Is the Profit Factor the only metric needed to assess the financial health of a business?

No, while the Profit Factor is an important indicator of profitability, it should be used in conjunction with other financial metrics such as net profit margin, return on investment (ROI), and cash flow analysis to get a comprehensive view of a business’s financial health.

How often should the Profit Factor be calculated?

The frequency of calculating the Profit Factor depends on the nature of the business and the level of financial monitoring required. It can be calculated on a quarterly basis for regular assessment or after significant business transactions or changes in the business model to understand their impact on profitability.