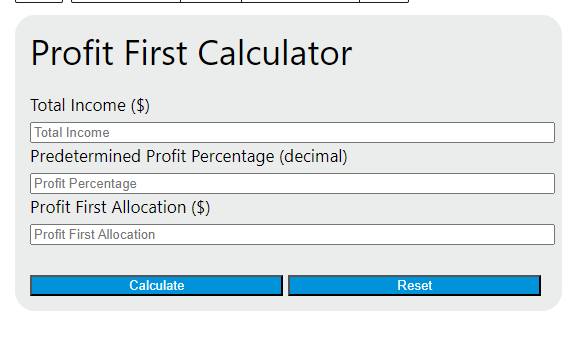

Enter the total income and predetermined profit percentage into the calculator to determine the Profit First allocation. This calculator can also evaluate any of the variables given the others are known.

Profit First Formula

The following formula is used to calculate the Profit First allocation.

PF = I * p

Variables:

- PF is the Profit First allocation ($)

- I is the total income ($)

- p is the predetermined profit percentage (decimal)

To calculate the Profit First allocation, multiply the total income by the predetermined profit percentage. This will give you the amount of money to set aside for profit before any expenses are paid. The remaining income is then used to cover business expenses. This approach ensures that a business remains profitable by prioritizing profit over expenses.

What is a Profit First?

Profit First is a financial management concept and methodology designed to ensure businesses become and remain profitable. The principle is simple: instead of calculating profit as what remains after expenses are subtracted from income, businesses should take profit first, setting aside a predetermined percentage of income before expenses. This approach forces businesses to adapt to running on the remaining income, thereby ensuring profitability. The concept was popularized by Mike Michalowicz in his book “Profit First”.

How to Calculate Profit First?

The following steps outline how to calculate the Profit First allocation using the formula: PF = I * p.

- First, determine the total income ($).

- Next, determine the predetermined profit percentage (decimal).

- Next, gather the formula from above = PF = I * p.

- Finally, calculate the Profit First allocation.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

total income ($) = 5000

predetermined profit percentage (decimal) = 0.15