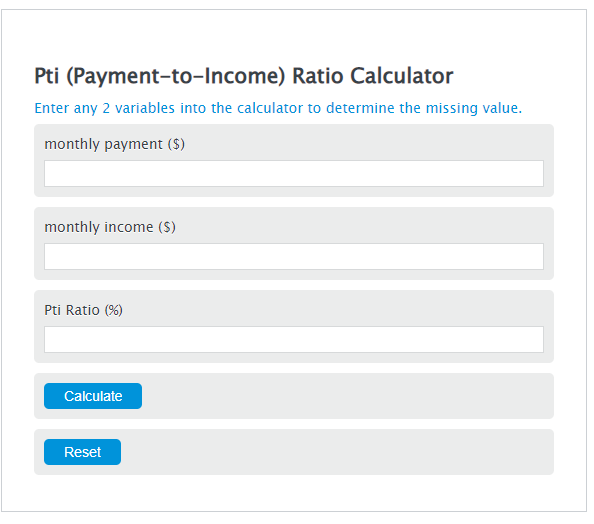

Enter the monthly payment ($) and the monthly income ($) into the Calculator. The calculator will evaluate the Pti Ratio.

Pti Ratio Formula

PTI = MP / MI * 100

Variables:

- PTI is the Pti Ratio (%)

- MP is the monthly payment ($)

- MI is the monthly income ($)

To calculate Pti Ratio, divide the monthly payments by the monthly income, then multiply by 100.

How to Calculate Pti Ratio?

The following steps outline how to calculate the Pti Ratio.

- First, determine the monthly payment ($).

- Next, determine the monthly income ($).

- Next, gather the formula from above = PTI = MP / MI * 100.

- Finally, calculate the Pti Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

monthly payment ($) = 400

monthly income ($) = 2000

Frequently Asked Questions (FAQ)

What is the importance of calculating the PTI ratio?

The PTI (Payment to Income) ratio is crucial for assessing an individual’s financial health, particularly when applying for loans. It helps lenders evaluate the borrower’s ability to afford monthly payments based on their income, thereby minimizing the risk of default.

How can a high PTI ratio affect loan approval?

A high PTI ratio indicates a significant portion of the borrower’s income is allocated towards debt payments, which can lead to loan application rejections. Lenders prefer a lower PTI ratio as it suggests better financial stability and a lower risk of default.

What is a good PTI ratio?

A good PTI ratio typically falls under 20-30%. This range suggests that the individual has a manageable debt load in relation to their income, which is favorable for both managing personal finances and for loan approvals.

Can the PTI ratio be improved?

Yes, the PTI ratio can be improved by either increasing monthly income or reducing monthly debt payments. Strategies include seeking higher-paying employment, taking on additional work, refinancing existing loans to lower payments, or paying off debts to reduce the monthly payment obligation.