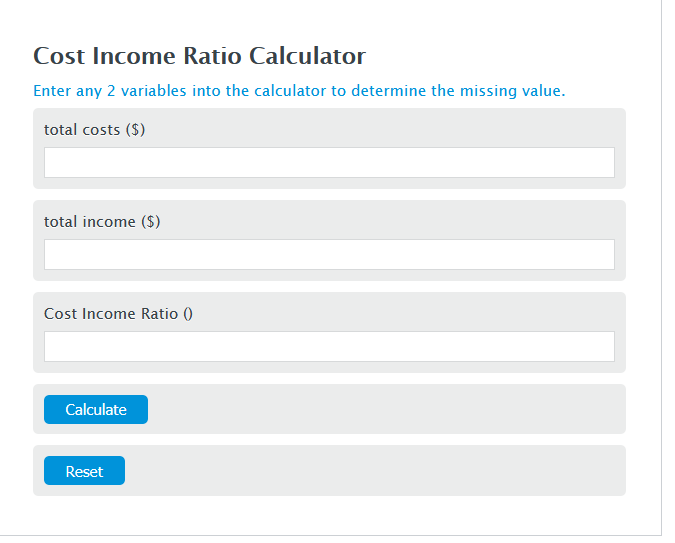

Enter the total costs ($) and the total income ($) into the Calculator. The calculator will evaluate the Cost Income Ratio.

Cost Income Ratio Formula

CIR = TC / TI

Variables:

- CIR is the Cost Income Ratio ()

- TC is the total costs ($)

- TI is the total income ($)

To calculate the Cost Income Ratio, divide the total costs by the income.

How to Calculate Cost Income Ratio?

The following steps outline how to calculate the Cost Income Ratio.

- First, determine the total costs ($).

- Next, determine the total income ($).

- Next, gather the formula from above = CIR = TC / TI.

- Finally, calculate the Cost Income Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total costs ($) = 4000

total income ($) = 3000

FAQ – Cost Income Ratio

What is the significance of the Cost Income Ratio in financial analysis?

The Cost Income Ratio (CIR) is a key financial metric that helps in assessing the efficiency of a company’s operations. It indicates what proportion of income is consumed by costs, thus providing insights into the profitability and financial health of the business. A lower CIR is generally preferable as it suggests that a smaller portion of revenue is being spent on costs.

Can the Cost Income Ratio be applied to personal finance?

Yes, the Cost Income Ratio can be applied to personal finance to evaluate an individual’s financial health. By comparing personal expenses (costs) to income, one can gauge how much of their income is being spent on expenses. This can be a useful tool in budgeting and financial planning, helping individuals to identify areas where they might reduce expenses to improve savings and investment.

How does the Cost Income Ratio differ from other financial ratios like the Debt to Income Ratio?

While the Cost Income Ratio focuses on the relationship between costs and income, the Debt to Income Ratio (DTI) measures an individual’s or entity’s monthly debt payments relative to their gross monthly income. DTI is often used by lenders to assess borrowing risk, whereas CIR is more broadly applied in evaluating operational efficiency and profitability.

Is a specific Cost Income Ratio ideal for all businesses or individuals?

No, an ideal Cost Income Ratio can vary significantly depending on the industry, business model, or individual circumstances. For businesses, sectors with higher operational costs may naturally have a higher CIR. Similarly, individuals with different financial goals and lifestyles will have different ideal ratios. It’s important to compare CIR against benchmarks within the relevant context rather than aiming for a universal target.