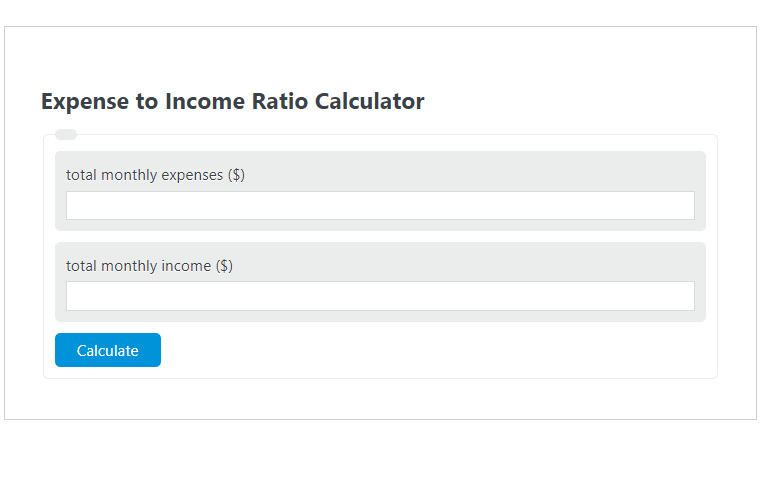

Enter the total monthly expenses ($) and the total monthly income ($) into the Expense to Income Ratio Calculator. The calculator will evaluate and display the Expense to Income Ratio.

- All Ratio Calculators

- Housing Expense Ratio Calculator

- Mortgage to Income Ratio Calculator

- Rent to Income Ratio Calculator

Expense to Income Ratio Formula

The following formula is used to calculate the Expense to Income Ratio.

EIR = E / I * 100

- Where EIR is the Expense to Income Ratio (%)

- E is the total monthly expenses ($)

- I is the total monthly income ($)

To calculate the expense-to-income ratio, divide the monthly expenses by the monthly income, then multiply by 100 if you want to express the result as a percentage.

How to Calculate Expense to Income Ratio?

The following example problems outline how to calculate Expense to Income Ratio.

Example Problem #1:

- First, determine the total monthly expenses ($).

- The total monthly expenses ($) is given as: 3,000.

- Next, determine the total monthly income ($).

- The total monthly income ($) is provided as: 7,000.

- Finally, calculate the Expense to Income Ratio using the equation above:

EIR = E / I * 100

The values given above are inserted into the equation below and the solution is calculated:

EIR = 3,000 / 7,000 * 100 = .428 (%)

FAQ

What is the importance of calculating the Expense to Income Ratio?

Calculating the Expense to Income Ratio is crucial for personal financial planning and management. It helps individuals understand how much of their income is being spent on expenses, which can be a key indicator of financial health. A lower ratio suggests better financial stability, as it indicates that a smaller portion of income is dedicated to expenses, leaving more for savings and investments.

How can one improve their Expense to Income Ratio?

Improving the Expense to Income Ratio can be achieved by either reducing monthly expenses or increasing monthly income. Strategies for reducing expenses include budgeting, cutting non-essential spending, and seeking more cost-effective options for necessary expenses. To increase income, individuals might consider seeking higher-paying employment, taking on additional work, or exploring passive income opportunities.

Is there an ideal Expense to Income Ratio?

While there’s no universally “ideal” Expense to Income Ratio, many financial advisors suggest aiming for a ratio of 50% or lower. This means that no more than half of one’s income should go towards expenses, allowing the remaining income to be allocated towards savings, investments, and debt repayment. However, the ideal ratio can vary based on individual financial goals and circumstances.