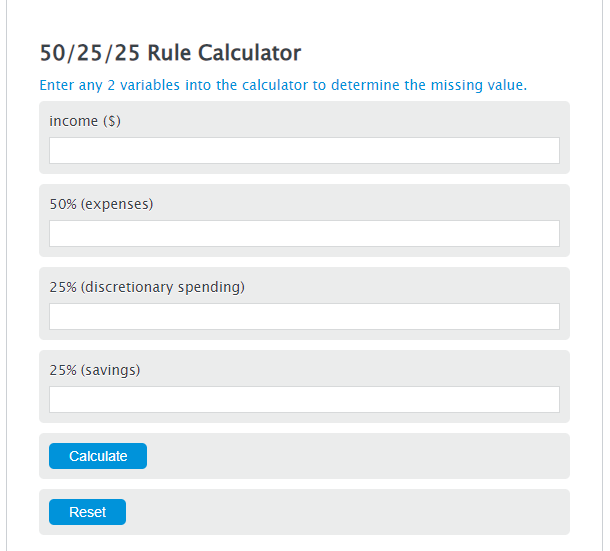

Enter the income ($) and the rule percentage rate into the Calculator. The calculator will evaluate the 50/25/25 Rule.

50/25/25 Rule Formula

B = I * R

Variables:

- B is the 50/25/25 Rule ($)

- I is the income ($)

- R is the rule percentage rate

To calculate 50/25/25 Rule, multiply the income by the rule rate.

How to Calculate 50/25/25 Rule?

The following steps outline how to calculate the 50/25/25 Rule.

- First, determine the income ($).

- Next, determine the rule percentage rate.

- Next, gather the formula from above = B = I * R.

- Finally, calculate the 50/25/25 Rule.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

income ($) = 3000

rule percentage rate = 5

Frequently Asked Questions

What is the 50/25/25 Rule and how does it apply to budgeting?

The 50/25/25 Rule is a budgeting principle that suggests allocating 50% of your income to necessities, 25% to savings, and the remaining 25% to discretionary expenses. It's a strategy designed to help individuals manage their finances by dividing their income into clear categories, ensuring that they cover essential expenses, save for the future, and still enjoy some discretionary spending.

Can the 50/25/25 Rule be adjusted based on personal financial goals?

Yes, the 50/25/25 Rule is a flexible guideline rather than a strict rule. Individuals can adjust the percentages based on their personal financial situations and goals. For instance, if someone has a higher income or fewer necessities, they might choose to allocate more towards savings or investments.

How does the 50/25/25 Rule compare to other budgeting methods like the 50/30/20 rule?

The 50/25/25 Rule is similar to the 50/30/20 rule, which allocates 50% of income to needs, 30% to wants, and 20% to savings. The main difference lies in the distribution between wants and savings. The 50/25/25 Rule suggests a higher savings rate, which might be more suitable for individuals focused on building their savings or investment portfolio more aggressively.

Is the 50/25/25 Rule suitable for everyone?

No budgeting rule is one-size-fits-all, and the 50/25/25 Rule is no exception. It's best suited for individuals looking for a balanced approach to managing their finances, with a strong emphasis on saving. Those with variable incomes, high debt levels, or unique financial situations may need to adapt the rule or seek a different budgeting strategy that better fits their needs.