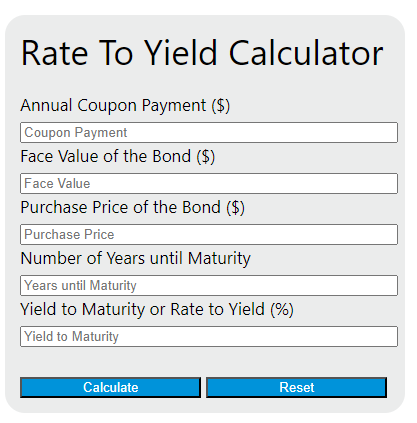

Enter the annual coupon payment, face value of the bond, purchase price of the bond, and the number of years until maturity into the calculator to determine the Yield to Maturity.

Rate To Yield Formula

The following formula is used to calculate the Rate to Yield or Yield to Maturity (YTM).

YTM = [(C + (F - P) / n) / ((F + P) / 2)] * 100

Variables:

- YTM is the Yield to Maturity or Rate to Yield (%)

- C is the annual coupon payment ($)

- F is the face value of the bond ($)

- P is the purchase price of the bond ($)

- n is the number of years until maturity

To calculate the Yield to Maturity, add the annual coupon payment to the result of subtracting the purchase price of the bond from its face value, divided by the number of years until maturity. Divide this sum by the average of the face value and the purchase price of the bond. Multiply the result by 100 to express the Yield to Maturity as a percentage.

What is a Rate To Yield?

Rate to Yield, often referred to as Yield to Maturity (YTM), is a financial concept that calculates the total annual return an investor would receive if a bond or other fixed-income investment is held until maturity. It takes into account both the interest payments received periodically and any capital gain or loss that would be realized upon maturity or sale. This rate is expressed as an annual percentage and is used by investors to compare the potential returns of different fixed-income investments.

How to Calculate Rate To Yield?

The following steps outline how to calculate the Rate To Yield (YTM).

- First, determine the annual coupon payment (C) ($).

- Next, determine the face value of the bond (F) ($).

- Next, determine the purchase price of the bond (P) ($).

- Next, determine the number of years until maturity (n).

- Next, gather the formula from above: YTM = [(C + (F – P) / n) / ((F + P) / 2)] * 100.

- Finally, calculate the Rate To Yield (YTM).

- After inserting the variables and calculating the result, check your answer with a financial calculator or online tool.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Annual coupon payment (C) ($) = 50

Face value of the bond (F) ($) = 1000

Purchase price of the bond (P) ($) = 950

Number of years until maturity (n) = 5