Enter the annual interest payment, face value, current price, and years to maturity of a bond. The calculator will evaluate and display the yield to maturity.

- Effective Annual Yield Calculator

- Marginal Utility Calculator

- Net Profit Margin Calculator

- Maturity Value Calculator

- 30-Day SEC Yield Calculator

- Maturity Gap Calculator

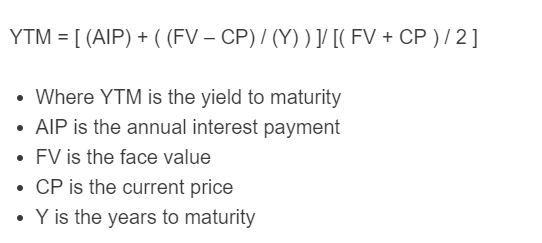

Yield to Maturity Formula

The following formula is used to calculate the yield to maturity of a bond or investment.

YTM = [ (AIP) + ( (FV – CP) / (Y) ) ]/ [( FV + CP ) / 2 ]

- Where YTM is the yield to maturity

- AIP is the annual interest payment

- FV is the face value

- CP is the current price

- Y is the years to maturity

Yield To Maturity Definition

Yield to Maturity (YTM) is a concept in investing that helps determine the potential return of a fixed-income security, such as bonds or notes, over its entire lifespan.

It represents the total annualized return an investor can expect to earn from holding the security until its maturity date, considering both the periodic coupon payments and the final principal repayment.

YTM is calculated by incorporating various factors, including the bond's current market price, face value, coupon rate, and time remaining until maturity.

It reflects the yield an investor would receive if they purchased the bond at its current price and held it until maturity, assuming all coupon payments are reinvested at the same YTM.

It helps investors compare and analyze different bonds with varying coupon rates, maturities, and market prices. By evaluating the YTM, investors can decide which bonds offer the most attractive returns and align with their investment objectives.

Yield To Maturity Example

How to calculate a yield to maturity?

- First, determine the annual interest payment.

Calculate the total annual interest payment.

- Next, determine the face value.

Calculate the face value of the bond.

- Next, determine the current price.

Calculate the current price of the bond on the market.

- Next, determine the years to maturity.

Measure the number of years remaining until maturity.

- Finally, calculate the yield to maturity.

Calculate the yield to maturity using the formula above.

FAQ

How does the current market price of a bond affect its yield to maturity?

The current market price of a bond inversely affects its yield to maturity (YTM). If the price of the bond falls below its face value, the YTM increases, as the investor is able to purchase the bond at a discount and still receive the full face value at maturity, along with the annual interest payments. Conversely, if the bond's price is above its face value, the YTM decreases, as the investor pays a premium for the bond, reducing the overall yield.

Why is it important for investors to understand yield to maturity?

Understanding yield to maturity (YTM) is crucial for investors as it provides a comprehensive measure of the bond's potential return, taking into account all cash flows from the time of purchase until maturity. It allows investors to compare the profitability of different bonds on a level playing field, regardless of their coupon rate, market price, or time to maturity. This helps in making informed investment decisions and in constructing a portfolio that aligns with one's risk tolerance and investment objectives.

Can yield to maturity change after a bond is purchased?

Yes, the yield to maturity (YTM) of a bond can change after it is purchased. The YTM is based on the current market price, which can fluctuate due to changes in interest rates, the issuer's credit rating, and other market conditions. However, the change in YTM does not affect the actual returns of the bond if held to maturity by the initial investor, as it reflects the yield based on the price at which the bond was purchased and assumes that all coupon payments are reinvested at the same yield.