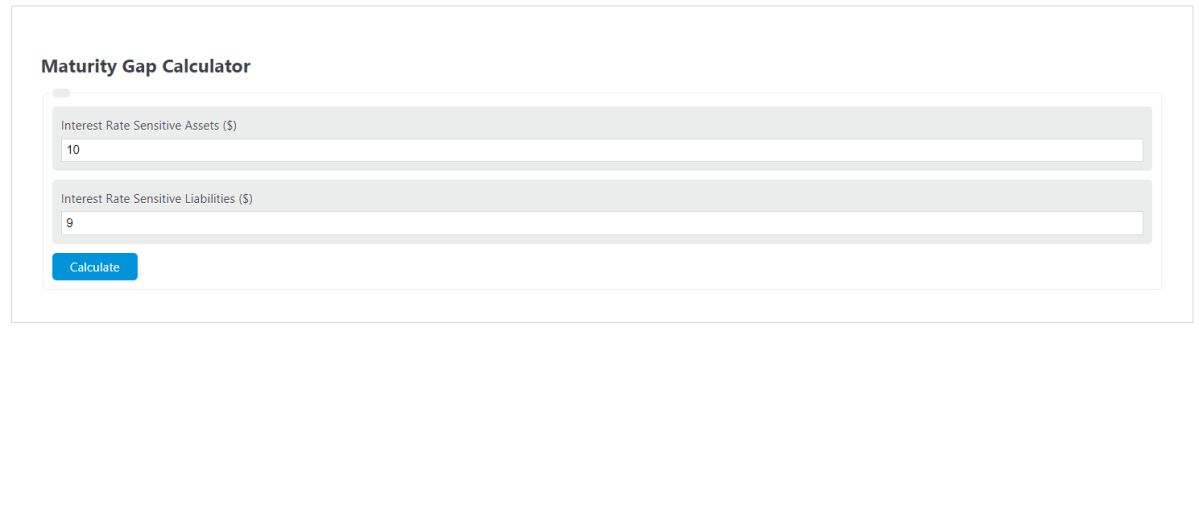

Enter the interest rate sensitive assets value and the interest rate sensitive liabilities value into the calculator to determine the Maturity Gap.

- Maturity Value Calculator

- Zero Coupon Bond Calculator

- Bond Carrying Value Calculator

- 30-Day SEC Yield Calculator

- Bond Dirty Price Calculator

Maturity Gap Formula

The following equation is used to calculate the Maturity Gap.

MG = IRSA - IRSL

- Where MG is the maturity gap ($)

- IRSA is the value of interest rate sensitive assets ($)

- IRSL is the value of interest rate sensitive liabilities ($)

To calculate a maturity gap, subtract the value of the interest rate sensitive assets from liabilities.

What is a Maturity Gap?

Definition:

A maturity gap is defined as the total difference between the values of interest rate sensitive assets and liabilities.

How to Calculate Maturity Gap?

Example Problem:

The following example outlines the steps and information needed to calculate Maturity Gap.

First, determine the interest rate sensitive assets value. In this case, the value of these are $10,000,000.00.

Next, determine the interest rate sensitive liabilities value. In this example, these are valued at $13,000,000.00

Finally, calculate the maturity gap using the formula above:

MG = IRSA – IRSL

MG = 10,000,000 – 13,000,000

MG = – $3,000,000.00