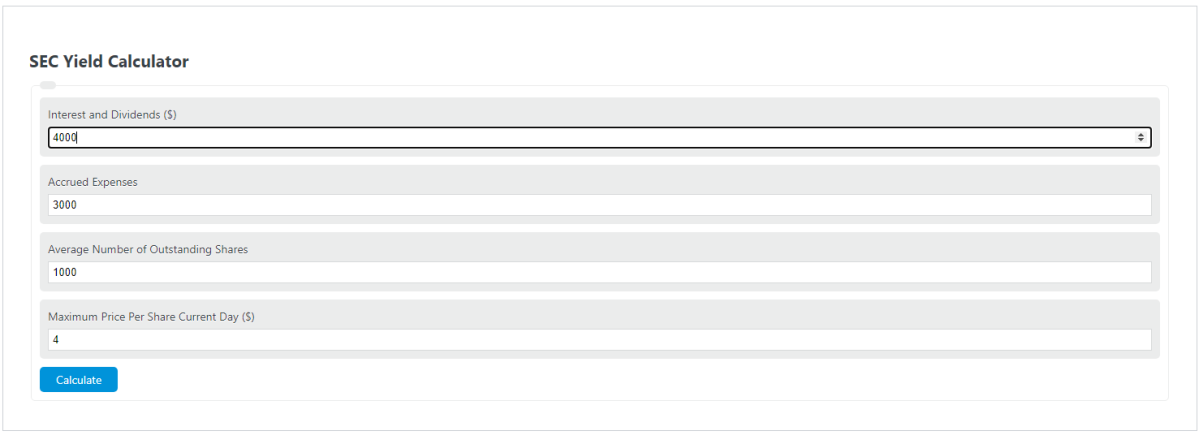

Enter the interest and dividends, accrued expenses, the average number of shares outstanding on a daily basis, and the maximum price per share to determine the 30-day SEC yield.

SEC Yield Formula

The following formula is used to calculate an SEC yield.

SECY = 2* (((a-b)/(c*d) + 1 ) ^ 6-1)

- Where SECY is the SEC yield

- a is the interest and dividends received over the last 30 days

- b is the accrued expenses over the last 30-days

- c is the average number of shares outstanding on a daily basis

- d is the maximum price per share on the last day/day of calculation

SEC Yield Definition

What is an SEC yield?

The SEC yield is a calculation that is used when comparing bond funds. It’s based on the previous 30-day period when the calculation is taking place.

Example Problem

how to calculate SEC yield?

First, determine the interest and dividends received over the last 30 days. In this example, this is found to be $4,000.00.

Next, determine the accrued expense. This is found to be $3,000.00 for the trailing 30-day period.

Next, determine the average number of shares outstanding. For this problem, this is found to be 1000.

Next, determine the maximum price per share on the current day. This is measured to be $4.00.

Finally, calculate the SEC yield using the formula above:

SECY = 2* (((a-b)/(c*d) + 1 ) ^ 6-1)

SECY = 2* (((4000-3000)/(1000*4) + 1 ) ^6-1)

SECY = 5.629