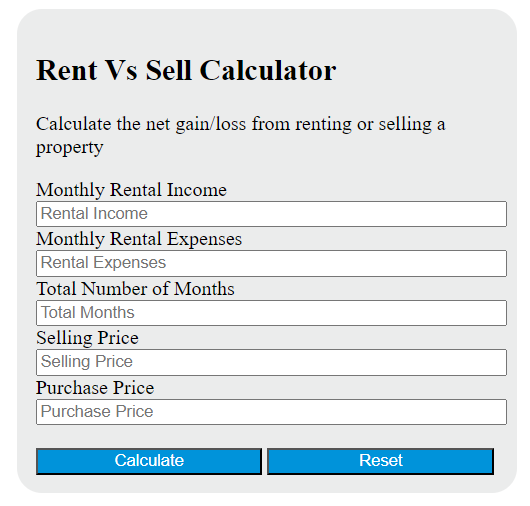

Enter all but one of the monthly rental income, monthly rental expenses, total number of months the property will be rented, selling price of the property, and purchase price of the property into the calculator to determine the net gain or loss from renting versus selling a property.

Rent Vs Sell Formula

The following formula is used to calculate the net gain or loss from renting versus selling a property:

Net Gain/Loss = (R - C) * T - (S - P)

Variables:

- Net Gain/Loss is the difference between the net rental income and the net selling income

- R is the monthly rental income

- C is the monthly rental expenses (including property management fees, maintenance costs, insurance, etc.)

- T is the total number of months the property will be rented

- S is the selling price of the property

- P is the purchase price of the property

To calculate the net gain or loss, subtract the total rental expenses from the monthly rental income, and multiply the result by the total number of months the property will be rented. Then, subtract the selling price of the property from the purchase price. Finally, subtract the second result from the first result to obtain the net gain or loss.

What is a Rent Vs Sell?

Rent vs Sell is a decision-making scenario often faced by property owners. It refers to the choice between renting out a property to generate a steady stream of income over a period of time (rent) or selling the property outright to realize a lump sum profit (sell). This decision is influenced by several factors including the property’s location, market conditions, the owner’s financial situation, and long-term goals. For instance, if the property is in a high-demand area with rising property values, the owner might choose to rent it out for now and sell it later when the property’s value has increased. On the other hand, if the owner needs immediate cash or if the property market is at its peak, selling might be the better option. Ultimately, the rent vs sell decision is a strategic one that requires careful consideration of various economic and personal factors.

How to Calculate Rent Vs Sell?

The following steps outline how to calculate the Rent Vs Sell decision.

- First, determine the rental income ($).

- Next, determine the selling price ($).

- Next, calculate the annual expenses for the property ($).

- Next, calculate the net operating income (NOI) by subtracting the annual expenses from the rental income.

- Next, calculate the capitalization rate (cap rate) by dividing the NOI by the selling price.

- Finally, compare the cap rate to the desired rate of return to make the Rent Vs Sell decision.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Rental income ($) = 1500

Selling price ($) = 200,000

Annual expenses ($) = 10,000