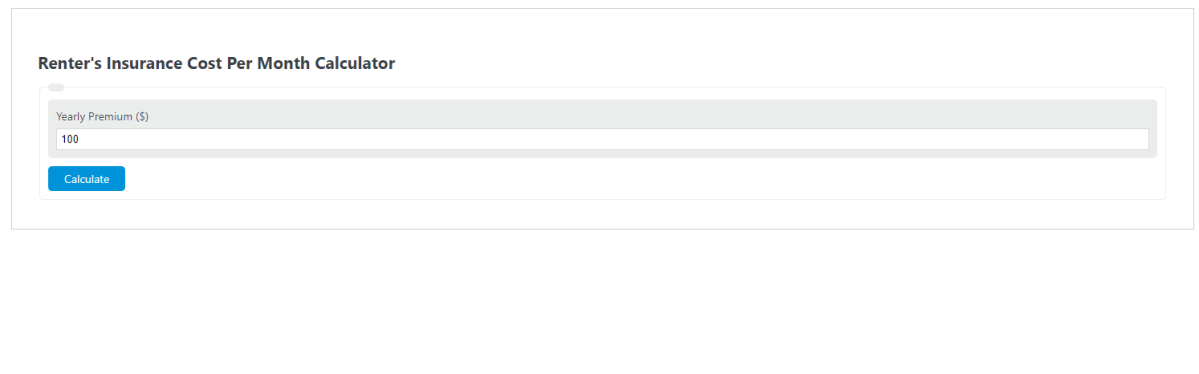

Enter the total yearly premium of the renter’s insurance into the calculator to determine the renter’s insurance cost per month, week, and day.

- Car Insurance Cost Per Month Calculator

- Life Insurance Cost Per Month Calculator

- Health Insurance Cost Per Month Calculator

- Utilities Cost Per Month Calculator

Renter Insurance Cost Per Month Formula

The following equation is used to calculate the Renter Insurance Cost Per Month.

RIC = YP / 12

- Where RIC is the renter’s insurance cost per month ($/month)

- YP is the yearly premium ($)

What is the Average Renter’s Insurance Cost Per Month?

The average renter’s insurance cost per month is $21.50.

Totaling rental property can be a stressful process. If you live in an apartment complex and your home gets damaged by fire or some other event, it may seem like all of your belongings are lost. This is why it’s important to have renters insurance. It protects your belongings in case something unexpected happens to your home.

FAQ

What factors influence the cost of renter’s insurance?

The cost of renter’s insurance can be influenced by several factors including the value of your personal belongings, your geographic location, the deductible you choose, the insurance company you go with, and any additional coverage options you may select.

Is renter’s insurance required by law?

No, renter’s insurance is not required by law. However, some landlords or property management companies may require tenants to have a minimum amount of renter’s insurance as part of their lease agreements.

What does renter’s insurance typically cover?

Renter’s insurance typically covers the personal property of the renter against risks such as theft, fire, and vandalism. It can also provide liability coverage in case someone is injured while in the rented property, and it may cover additional living expenses if the rental property becomes uninhabitable due to a covered loss.