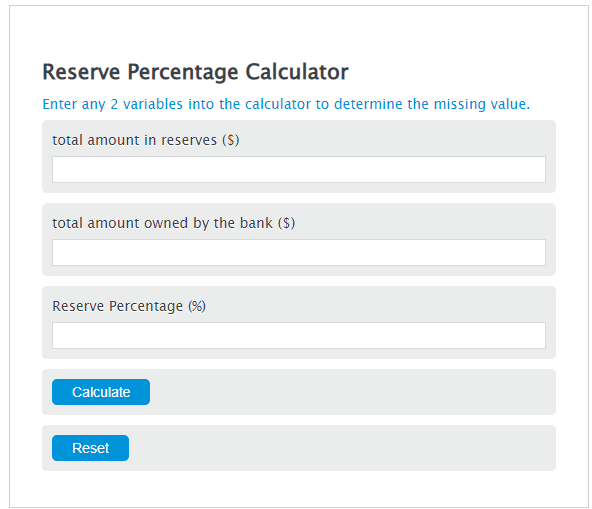

Enter the total amount in reserves ($) and the total amount owned by the bank ($) into the Calculator. The calculator will evaluate the Reserve Percentage.

Reserve Percentage Formula

RSR = TR / TB * 100

Variables:

- RSR is the Reserve Percentage (%)

- TR is the total amount in reserves ($)

- TB is the total amount owned by the bank ($)

To calculate the Reserve Percentage, divide the total amount in reserves by the total amount owned by the bank, then multiply by 100.

How to Calculate Reserve Percentage?

The following steps outline how to calculate the Reserve Percentage.

- First, determine the total amount in reserves ($).

- Next, determine the total amount owned by the bank ($).

- Next, gather the formula from above = RSR = TR / TB * 100.

- Finally, calculate the Reserve Percentage.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total amount in reserves ($) = 500000

total amount owned by the bank ($) = 10000000

FAQs

What is the significance of calculating the Reserve Percentage for a bank?

The Reserve Percentage is crucial for banks as it indicates the portion of depositors’ funds that are held in reserve and not lent out, ensuring the bank maintains enough liquidity to meet withdrawal demands and regulatory requirements.

How does the Reserve Percentage affect a bank’s ability to lend?

A lower Reserve Percentage means the bank has more funds available to lend, potentially increasing its profitability through interest earnings. Conversely, a higher Reserve Percentage limits the amount available for lending, impacting the bank’s income from loans.

Can the Reserve Percentage change over time?

Yes, the Reserve Percentage can change due to regulatory requirements, the bank’s liquidity needs, or changes in the total amount of reserves or assets owned by the bank. Banks must adjust their lending activities and reserve holdings accordingly.

Why might a bank aim for a Reserve Percentage higher than the minimum required?

Banks might maintain a higher Reserve Percentage to ensure extra liquidity for unexpected withdrawal demands, to strengthen financial stability, or in response to uncertain economic conditions. This conservative approach can help protect the bank during financial downturns.