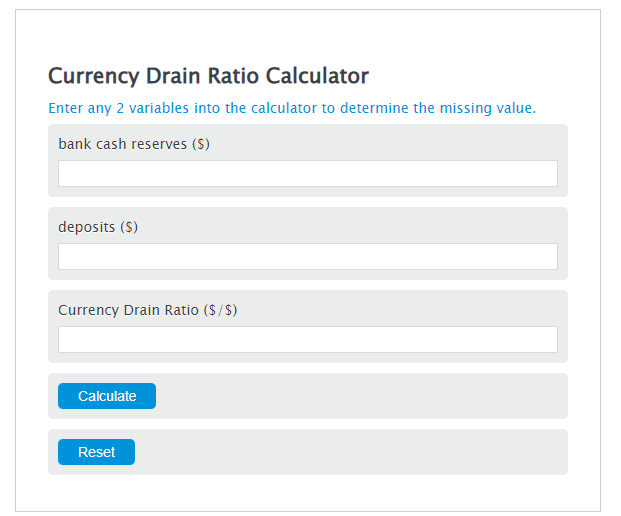

Enter the bank cash reserves ($) and the deposits ($) into the Calculator. The calculator will evaluate the Currency Drain Ratio.

Currency Drain Ratio Formula

CDR = BCR / D

Variables:

- CDR is the Currency Drain Ratio ($/$)

- BCR is the bank cash reserves ($)

- D is the deposits ($)

To calculate the Currency Drain Ratio, divide the current bank cash reserves by the deposits.

How to Calculate Currency Drain Ratio?

The following steps outline how to calculate the Currency Drain Ratio.

- First, determine the bank cash reserves ($).

- Next, determine the deposits ($).

- Next, gather the formula from above = CDR = BCR / D.

- Finally, calculate the Currency Drain Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

bank cash reserves ($) = 1000

deposits ($) = 2000

Frequently Asked Questions

What is the significance of the Currency Drain Ratio in banking?

The Currency Drain Ratio is significant as it helps banks and financial institutions understand the proportion of cash reserves to deposits. This ratio is crucial for maintaining liquidity and ensuring that banks have enough cash on hand to meet withdrawal demands without compromising their financial stability.

How can banks manage a high Currency Drain Ratio?

Banks can manage a high Currency Drain Ratio by adopting strategies such as increasing their reserves, optimizing their asset and liability management, and offering incentives to encourage customers to maintain or increase their deposits. Additionally, banks may also invest in liquid assets that can be easily converted to cash.

What impact does the Currency Drain Ratio have on monetary policy?

The Currency Drain Ratio can significantly impact monetary policy by influencing the central bank’s decisions on interest rates and reserve requirements. A high ratio may prompt the central bank to implement policies to control inflation or stimulate economic growth, whereas a low ratio might indicate an excess of liquidity in the banking system, leading to different policy adjustments.

Can the Currency Drain Ratio affect individual savers and investors?

Yes, the Currency Drain Ratio can affect individual savers and investors by influencing the interest rates on savings and investment products. A higher ratio may lead banks to offer higher interest rates to attract more deposits, while a lower ratio might result in lower interest rates. Understanding this ratio can help individuals make informed decisions about where to place their funds.