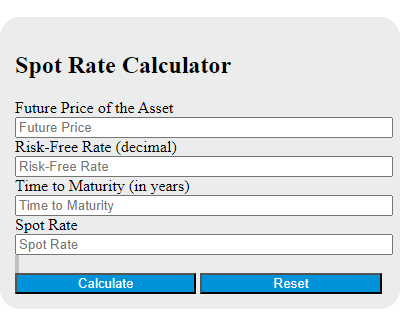

Enter the future price of the asset, the risk-free rate, and the time to maturity into the calculator to determine the spot rate. This calculator can also evaluate any of the variables given the others are known.

Spot Rate Formula

The following formula is used to calculate the spot rate.

SR = FP / (1 + r)^t

Variables:

- SR is the spot rate

- FP is the future price of the asset

- r is the risk-free rate (decimal)

- t is the time to maturity (in years)

To calculate the spot rate, divide the future price of the asset by the sum of 1 and the risk-free rate raised to the power of the time to maturity. The result is the spot rate, which represents the current market price at which the asset can be bought or sold for immediate delivery and payment.

What is a Spot Rate?

A spot rate, also known as the “spot price,” is the current market price at which a particular asset, such as a security, commodity, or currency, can be bought or sold for immediate delivery and payment. It reflects the value of an asset at a specific point in time and can fluctuate based on supply and demand dynamics in the market. Spot rates are used in financial markets for trading purposes and are also used to calculate forward rates and future cash flows.

How to Calculate Spot Rate?

The following steps outline how to calculate the Spot Rate.

- First, determine the future price of the asset (FP).

- Next, determine the risk-free rate (r) as a decimal.

- Next, determine the time to maturity (t) in years.

- Next, gather the formula from above = SR = FP / (1 + r)^t.

- Finally, calculate the Spot Rate.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

future price of the asset (FP) = 100

risk-free rate (r) = 0.05

time to maturity (t) = 2