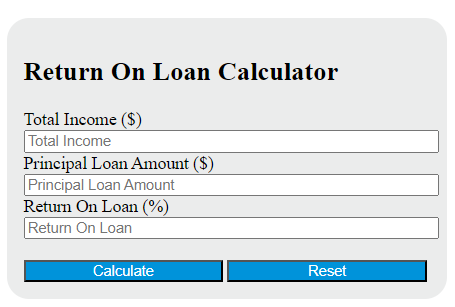

Enter the total income received from the loan and the principal loan amount into the calculator to determine the return on loan. This calculator can also evaluate any of the variables given the others are known.

- Certificate of Deposit Return Calculator (CD Calculator)

- Loan Calculator with Interest

- Unearned Interest Calculator

Return On Loan Formula

The following formula is used to calculate the return on loan.

ROL = (I - P) / P

Variables:

- ROL is the return on loan (%)

- I is the total income received from the loan ($)

- P is the principal loan amount ($)

To calculate the return on loan, subtract the principal loan amount from the total income received from the loan. Then, divide the result by the principal loan amount. The result is the return on loan expressed as a percentage.

What is a Return On Loan?

A Return On Loan (ROL) is a measure of the profitability or return that a lender receives from the interest and fees paid by the borrower on a loan. It is calculated by dividing the total income generated from the loan by the total amount of the loan. This metric is used by financial institutions to assess the effectiveness of their lending activities and to make decisions about pricing and risk management.

How to Calculate Return On Loan?

The following steps outline how to calculate the Return On Loan.

- First, determine the total income received from the loan ($).

- Next, determine the principal loan amount ($).

- Next, gather the formula from above = ROL = (I – P) / P.

- Finally, calculate the Return On Loan.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total income received from the loan ($) = 500

principal loan amount ($) = 1000