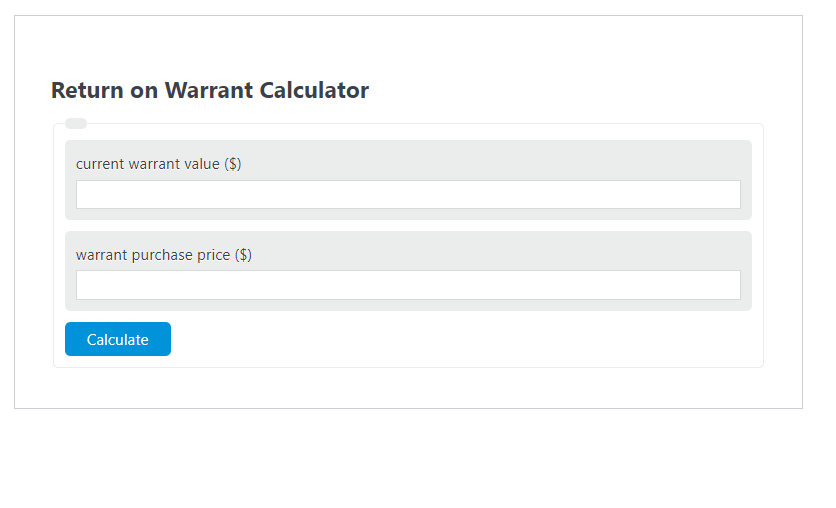

Enter the current warrant value ($) and the warrant purchase price ($) into the Return on Warrant Calculator. The calculator will evaluate and display the Return on Warrant.

- Return on “X” Calculators

- Return on Leverage Calculator

- Return on Cash Calculator

- Return on Net Operating Assets Calculator

Return on Warrant Formula

The following formula is used to calculate the Return on Warrant.

ROW = (CWV - WPP) / WPP * 100

- Where ROW is the Return on Warrant (%)

- CWV is the current warrant value ($)

- WPP is the warrant purchase price ($)

How to Calculate Return on Warrant?

The following example problems outline how to calculate Return on Warrant.

Example Problem #1:

- First, determine the current warrant value ($).

- The current warrant value ($) is given as: 500.

- Next, determine the warrant purchase price ($).

- The warrant purchase price ($) is provided as: 250.

- Finally, calculate the Return on Warrant using the equation above:

ROW = (CWV – WPP) / WPP * 100

The values given above are inserted into the equation below and the solution is calculated:

ROW = (500 – 250) / 250 * 100 = 100.00 (%)

FAQ

What is a warrant in financial terms?

A warrant is a financial instrument that gives the holder the right, but not the obligation, to buy a company’s stock at a specified price before the warrant expires. It is similar to an option, but typically issued by the company itself and often has a longer term to expiration.

How does the Return on Warrant (ROW) differ from stock returns?

Return on Warrant (ROW) specifically measures the percentage gain or loss made on a warrant investment, considering the purchase price and the current value of the warrant. Stock returns, on the other hand, measure the gain or loss on the stock itself, taking into account dividends received and changes in stock price. ROW calculations are specific to warrants and take into account the unique mechanics of warrant pricing and expiration.

Can the Return on Warrant be negative?

Yes, the Return on Warrant can be negative. This occurs when the current warrant value is less than the warrant purchase price, indicating that the value of the warrant has decreased since it was purchased. A negative ROW signifies a loss on the warrant investment.