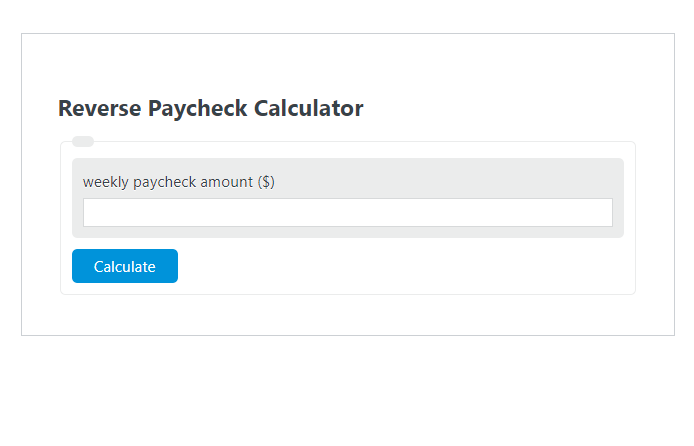

Enter the weekly paycheck amount ($) into the Reverse Paycheck Calculator. The calculator will evaluate and display the annual equivalent pay.

- All Reverse Calculators

- Reverse Inflation Calculator

- Reverse Tip Calculator

- Reverse Split Calculator

Reverse Paycheck Formula

The following formula is used to calculate the Reverse Paycheck.

AS = WP * 52

- Where AS is the Reverse Paycheck ($/year)

- WP is the weekly paycheck amount ($)

How to Calculate Reverse Paycheck?

The following example problems outline how to calculate Reverse Paycheck.

Example Problem #1:

- First, determine the weekly paycheck amount ($).

- The weekly paycheck amount ($) is given as: 500.

- Finally, calculate the Reverse Paycheck using the equation above:

AS = WP * 52

The values given above are inserted into the equation below and the solution is calculated:

AS = WP * 52 = 26,000 ($/year)

FAQ

What does the Reverse Paycheck Calculator help with?

The Reverse Paycheck Calculator is designed to help individuals understand what their weekly paycheck amounts to on an annual basis. By inputting their weekly earnings, users can quickly see their yearly salary, which can be useful for budgeting, financial planning, and comparing job offers.

Can the Reverse Paycheck Calculator be used for salaries that are not paid weekly?

Yes, while the calculator is designed for weekly paychecks, it can be adapted for other pay frequencies by adjusting the formula accordingly. For bi-weekly paychecks, for example, you would multiply by 26 (the number of bi-weekly periods in a year) instead of 52.

Is it important to consider taxes and deductions when using the Reverse Paycheck Calculator?

Absolutely. The Reverse Paycheck Calculator provides a gross annual salary estimate based on weekly earnings. It does not account for taxes, retirement contributions, health insurance premiums, or other deductions that may reduce your take-home pay. For a more accurate picture of your financial situation, these factors should be considered separately.