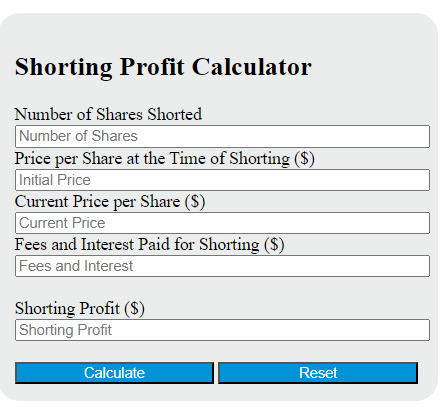

Enter the number of shares shorted, the price per share at the time of shorting, the current price per share, and the fees and interest paid for shorting into the calculator to determine the shorting profit.

Shorting Profit Formula

The following formula is used to calculate the profit from short selling.

SP = N * (PP - CP) - F

Variables:

- SP is the shorting profit ($)

- N is the number of shares shorted

- PP is the price per share at the time of shorting (initial price) ($)

- CP is the current price per share ($)

- F is the fees and interest paid for shorting ($)

To calculate the shorting profit, subtract the current price per share from the price per share at the time of shorting, then multiply the result by the number of shares shorted. Subtract the fees and interest paid for shorting from this result.

What is a Shorting Profit?

Shorting profit refers to the gains made from short selling, a trading strategy where an investor borrows shares and immediately sells them, hoping to buy them back later at a lower price, return them to the lender and pocket the difference. The strategy is based on the expectation that the price of the borrowed securities will drop. Therefore, a shorting profit is the money made when this expectation is realized, and the securities are repurchased for less than the initial selling price.

How to Calculate Shorting Profit?

The following steps outline how to calculate the Shorting Profit.

- First, determine the number of shares shorted (N).

- Next, determine the price per share at the time of shorting (PP) ($).

- Next, determine the current price per share (CP) ($).

- Next, determine the fees and interest paid for shorting (F) ($).

- Next, gather the formula from above = SP = N * (PP – CP) – F.

- Finally, calculate the Shorting Profit.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

number of shares shorted (N) = 100

price per share at the time of shorting (PP) ($) = 50

current price per share (CP) ($) = 45

fees and interest paid for shorting (F) ($) = 10