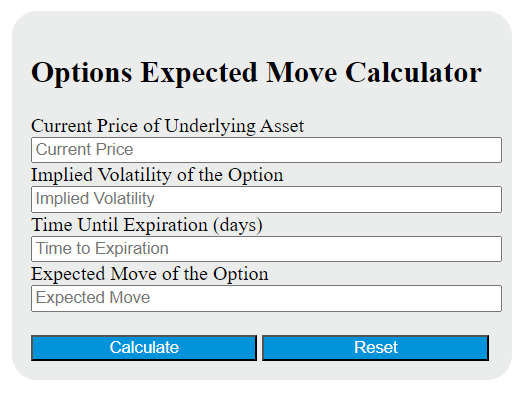

Enter the current price of the underlying asset, the implied volatility of the option, and the time until expiration into the calculator to determine the expected move of the option.

Options Expected Move Formula

The following formula is used to calculate the expected move of an option.

EM = S * IV * sqrt(T/365)

Variables:

- EM is the expected move of the option

- S is the current price of the underlying asset

- IV is the implied volatility of the option

- T is the time until expiration in days

To calculate the expected move of an option, multiply the current price of the underlying asset by the implied volatility of the option. Then, take the square root of the time until expiration in days divided by 365. The result is the expected move of the option.

What is an Options Expected Move?

Options Expected Move is a financial metric used in options trading to predict the potential price range of an underlying asset, such as a stock, within a certain period. It is calculated based on the price of the options contracts for that asset and represents the one standard deviation price range. This means that the market predicts there is a 68% probability that the price of the asset will fall within this range. This information can be useful for traders in making decisions about buying or selling options.

How to Calculate Options Expected Move?

The following steps outline how to calculate the Options Expected Move using the given formula:

- First, determine the current price of the underlying asset (S).

- Next, determine the implied volatility of the option (IV).

- Next, determine the time until expiration in days (T).

- Next, gather the formula from above = EM = S * IV * sqrt(T/365).

- Finally, calculate the Options Expected Move (EM).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge:

Current price of the underlying asset (S) = $50

Implied volatility of the option (IV) = 0.2

Time until expiration in days (T) = 90