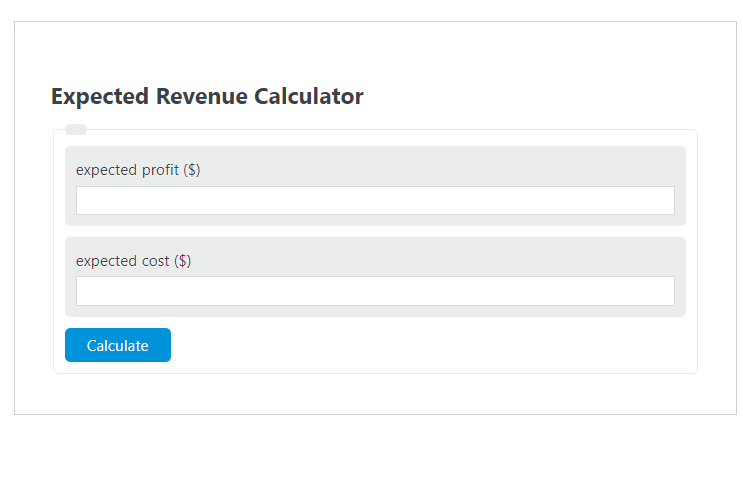

Enter the expected profit ($) and the expected cost ($) into the calculator to determine the Expected Revenue.

- All Revenue Calculators

- Expected Profit Calculator

- Company Valuation Based on Revenue Calculator

- Business Revenue Calculator

Expected Revenue Formula

The following formula is used to calculate the Expected Revenue.

ER = EP + EC

- Where ER is the Expected Revenue ($)

- EP is the expected profit ($)

- EC is the expected cost ($)

How to Calculate Expected Revenue?

The following example problems outline how to calculate Expected Revenue.

Example Problem #1:

- First, determine the expected profit ($). In this example, the expected profit ($) is given as 58.

- Next, determine the expected cost ($). For this problem, the expected cost ($) is given as 2.

- Finally, calculate the Expected Revenue using the equation above:

ER = EP + EC

The values given above are inserted into the equation below:

ER = 58 + 2 = 60 ($)

FAQ

What is the difference between expected revenue and actual revenue?

Expected revenue is a forecasted figure based on assumptions about future sales, costs, and profits. Actual revenue, on the other hand, is the real income that a company generates from its operations, which can differ from predictions due to various factors such as market demand, competition, and operational challenges.

How can expected revenue calculations impact business planning?

Expected revenue calculations are crucial for business planning as they help in budgeting, setting financial goals, and making informed decisions about investments, expansions, and resource allocation. Accurate forecasts enable businesses to anticipate cash flows, manage risks, and adjust strategies to meet financial objectives.

Why is it important to consider both expected profit and expected cost when calculating expected revenue?

Considering both expected profit and expected cost is essential because it provides a more comprehensive view of a company’s financial health. Expected profit indicates the potential earnings after accounting for costs, while expected cost gives insight into the expenses involved in generating revenue. Together, they help in assessing the profitability and sustainability of business operations.