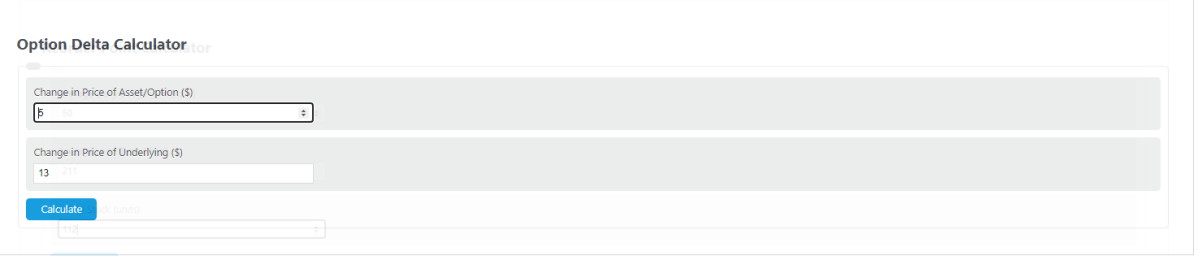

Enter the change in the price of the asset and the change in the price of the underlying to calculate the option delta.

- Reverse Stock Split Calculator

- Cost of Preferred Stock Calculator

- Cost of Capital Calculator

- Stock Calculator (Profit Calculator)

- Conversion Parity Price Calculator

- Butterfly Spread Profit Calculator

- Max Loss Per Share Calculator

Option Delta Formula

The following formula is used to calculate an option delta.

D = CA / CU

- Where D is the option delta

- CA is the change in the value of the asset (option) ($)

- CU is the change in the value of the underlying security ($)

To calculate the option delta, divide the change in value of the asset by the change in value of the underlying security.

Option Delta Definition

An option delta is defined as the ratio of the change in the value of an option, or asset, to the change in the value of the underlying security.

This term is sometimes referred to as a hedge ratio.

How to calculate option delta?

Example Problem #1:

First, determine the change in the value of the asset. For this example, the option changed in value of 1$ over the course of a week.

Next, determine the change in the value of the underlying. For this problem, the underlying security option is tied to change $1.25 over the same week.

Finally, calculate the option delta using the formula above:

D = CA / CU

= 1/1.25

= .80.

Example Problem #2:

In this next example, the option has a change in the value of $100.00 over a month period.

Over the same month, the underlying had changed in value by $200.00.

Using the same formula as example 1:

D = CA/CU

= 100/200

= .5.