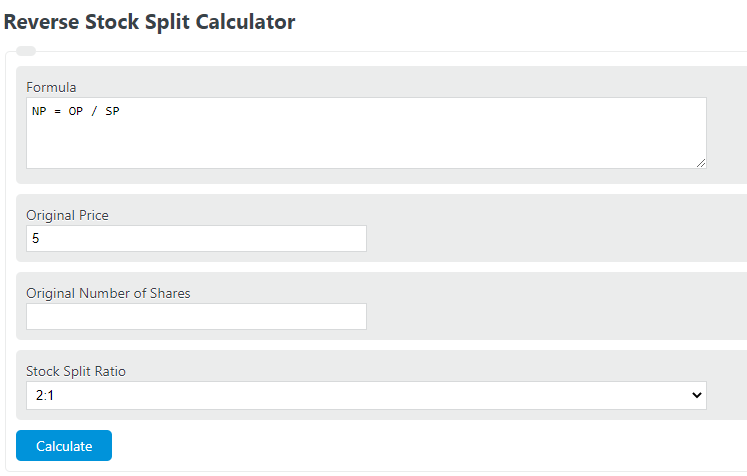

Enter the current stock price, the number of shares owned, and the stock split ratio into the calculator to determine the new price and shares owned.

Reverse Stock Split Formula

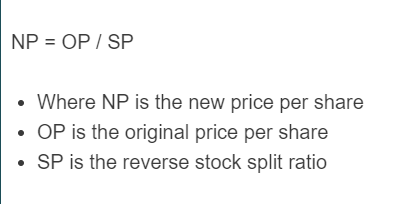

The following formula is used to calculate the new price of a stock after a reverse stock split.

NP = OP / SP

- Where NP is the new price per share

- OP is the original price per share

- SP is the reverse stock split ratio

To calculate the new price per share from a reverse stock split, divide the original price per share by the reverse stock split ratio.

What Is a Reverse Stock Split?

In a reverse stock split, the number of existing shares of a stock is consolidated into fewer shares that are worth more money. It is also called a stock merge, a share rollback, or a stock consolidation and it is done primarily to bump the price of each share of stock. However, it doesn’t increase the value because people have fewer shares.

Reverse Stock Split Example

How to calculate a reverse stock split?

- First, determine the reverse split ratio.

For example, a reverse split of 2:1 would mean every 2 shares now equals 1 share.

- Next, determine the original price.

Determine the original share price.

- Finally, calculate the new share price.

Calculate the new share price using the formula above.

FAQ

Do You Lose Money on a Reverse Split?

When companies complete a reverse split on stocks, each existing share becomes a fraction of a share. So if the reverse split is one for ten, every ten shares become one share. If you had 10,000 shares, you will now have 1000 shares. However, the value stays the same.

At the same time, some small shareholders might cash out and receive cash for partial shares. Also, the reverse split could kick off trading, which can cause investors to lose money. Investors could also make money if people decide to buy shares and drive the value up.

What Is a 1 to 8 Reverse Stock Split?

In a 1 to 8 reverse stock split, every share will become ⅛ of a share or .125 shares. The easy way to explain it is that if you have 8 shares, you will have 1 share that is worth the same as the 8 shares were worth. So if each share was worth $1, you had $8 worth of stock. You still have $8 of stock, but you have only one share.

What Are the Advantages of a Reverse Stock Split?

The advantages of a reverse stock split are mostly for the company that is doing it. First of all, they do it so that they don’t risk getting delisted from the NYSE or the NASDAQ. If a company’s stock price drops and it trades below $1 for an extended period, it may delist it.

In addition, the reverse stock split can boost the company’s image. Having a low stock value can be seen as negative by investors, and they may sell more than they buy. If they keep the favor of investors, they can help drive the price up.

What Are the Disadvantages of a Reverse Stock Split?

There are a few disadvantages to the reverse stock split. First, it can reduce liquidity because there will be fewer shares of stock. In addition, some people view a reverse stock split as a sign that there is something wrong with the company. It is common for people to sell some of their shares after a reverse stock split, which can lower the value.

Why Do Penny Stocks Do Reverse Splits?

Penny stocks are small companies, and their shares trade at anywhere from less than a cent up to five dollars. People like to speculate by buying a large number of shares, but this can be dangerous. These small companies often go out of business, so they are at high risk.

They are known for doing reverse splits when they have sold all of their authorized stock. This allows it to make the stocks look more attractive, as they can go up from a dollar to twenty, thirty, or more dollars.

Final Words

A reverse stock split happens when a company consolidates its stock to increase the value of each share. The overall value remains the same, but you will have fewer shares.