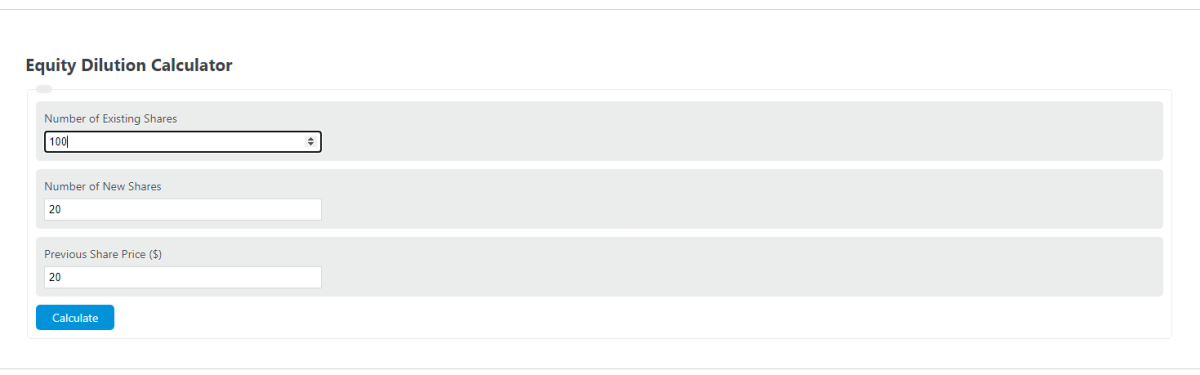

Enter the existing or previous number of shares and the new number of shares into the calculator to determine the equity dilution percentage.

- Reverse Stock Split Calculator

- Option Delta Calculator

- Average Cost Basis Calculator

- ESOP Calculator

- ATR (Average True Range) Stop Loss Calculator

- Net New Equity Calculator

Equity Dilution Formula

The following formula is used to calculate the dilution percentage of equity contained within shares of a company.

D = ([ES - NS] / ES * 100)

- Where D% is the total dilution percentage

- ES is the number of existing shares

- NS is the number of new shares

It should be noted that the above formula does not take into account an increase in the price of the stock due to a new valuation of the investment.

Equity Dilution Definition

An equity dilution is defined as the reduction in the value of a stock or asset due to the addition of new stocks into the total pool available.

In other words, how much percentage reduction the price would drop if a certain number of shares were issued.

Example Problem

How to calculate equity dilution?

First, determine the current number of shares on the market. For this example problem, the total number of existing shares is 1,000,000.

A new investor is looking to invest in the company, and the company plans to issue new stock to the investor. In this case, the new investor is set to receive 200,000 in newly issued stock.

Finally, calculate the total percentage of equity dilution.

Using the formula above:

D% = [ES – NS] / ES * 100

= 80% dilution

This means that any current stock owned by other individuals would now be worth 80% of the previous value before dilution.

For example, if a stock was worth 20$ before the new stock was issued, the new price would be:

20*.80 = $16.