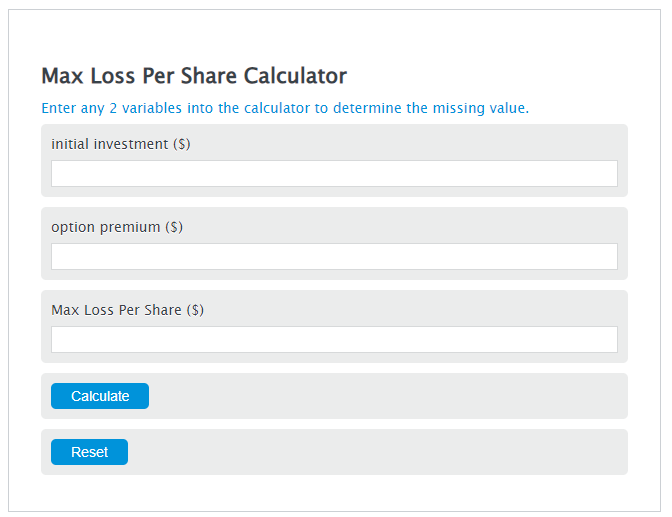

Enter the initial investment ($) and the option premium ($) into the Calculator. The calculator will evaluate the Max Loss Per Share.

Max Loss Per Share Formula

MLPS = II - OP

Variables:

- MLSP is the Max Loss Per Share ($)

- II is the initial investment ($)

- OP is the option premium ($)

To calculate Max Loss Per Share, subtract the option premium from the initial investment.

How to Calculate Max Loss Per Share?

The following steps outline how to calculate the Max Loss Per Share.

- First, determine the initial investment ($).

- Next, determine the option premium ($).

- Next, gather the formula from above = MLPS = II – OP.

- Finally, calculate the Max Loss Per Share.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

initial investment ($) = 200

option premium ($) = 40

FAQs

What is an option premium?

An option premium is the price paid by the buyer to the seller to acquire the rights of an option contract. It is determined by several factors including the underlying asset’s price, volatility, time until expiration, and interest rates.

How does the initial investment affect the Max Loss Per Share?

The initial investment is a crucial factor in calculating the Max Loss Per Share (MLPS). A higher initial investment increases the potential max loss per share, as it represents a larger amount of capital at risk.

Can the Max Loss Per Share ever be positive?

No, the Max Loss Per Share (MLPS) represents a loss and therefore should always be a negative number or zero. A positive number would indicate a gain, not a loss.

Why is it important to calculate Max Loss Per Share?

Calculating the Max Loss Per Share is important for investors to understand the maximum amount they can lose on a per-share basis. This helps in risk management and in making informed decisions about option investments.