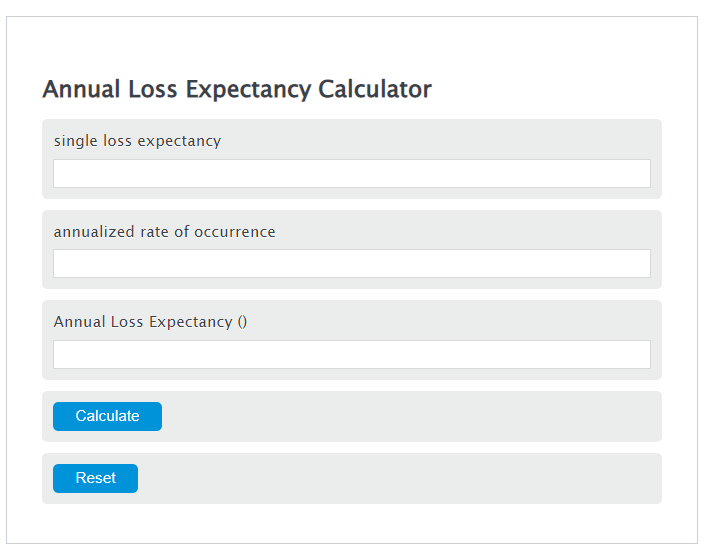

Enter the single loss expectancy and the annualized rate of occurrence into the Calculator. The calculator will evaluate the Annual Loss Expectancy.

Annual Loss Expectancy Formula

ALE = SLE * ARO

Variables:

- ALE is the Annual Loss Expectancy ()

- SLE is the single loss expectancy

- ARO is the annualized rate of occurrence

To calculate Annual Loss Expectancy, multiply the single loss expectancy by the annualized rate of occurence.

How to Calculate Annual Loss Expectancy?

The following steps outline how to calculate the Annual Loss Expectancy.

- First, determine the single loss expectancy.

- Next, determine the annualized rate of occurrence.

- Next, gather the formula from above = ALE = SLE * ARO.

- Finally, calculate the Annual Loss Expectancy.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

single loss expectancy = 30

annualized rate of occurrence = 0.75

FAQs

What is Single Loss Expectancy (SLE)?

Single Loss Expectancy (SLE) is a term used in risk management and represents the expected monetary loss for a single event. It is a component in calculating the Annual Loss Expectancy (ALE) and helps organizations in assessing the potential financial impact of specific risks.

How does the Annualized Rate of Occurrence (ARO) affect the Annual Loss Expectancy?

The Annualized Rate of Occurrence (ARO) is a factor that represents the estimated frequency of a specific event occurring within a year. A higher ARO increases the Annual Loss Expectancy (ALE), indicating a greater expected loss over the course of a year due to more frequent occurrences of the event.

Why is calculating Annual Loss Expectancy important for businesses?

Calculating Annual Loss Expectancy (ALE) is crucial for businesses as it helps in the identification, assessment, and prioritization of risks. Understanding ALE enables organizations to make informed decisions regarding risk management strategies, including the implementation of controls and the allocation of resources towards mitigating potential losses.

Can the Annual Loss Expectancy formula be used for all types of risks?

The Annual Loss Expectancy (ALE) formula is a versatile tool in risk management and can be applied to a wide range of risks that can be quantified in terms of their potential financial impact. However, it is most effective when used for risks where both the Single Loss Expectancy (SLE) and the Annualized Rate of Occurrence (ARO) can be accurately estimated.