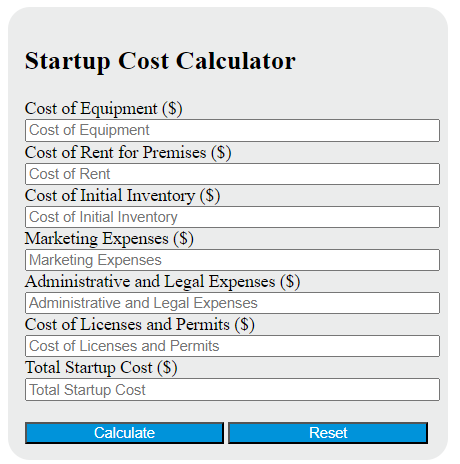

Enter the cost of equipment, rent for premises, initial inventory, marketing expenses, administrative and legal expenses, and the cost of licenses and permits into the calculator to determine the total startup cost.

Startup Cost Formula

The following formula is used to calculate the startup cost for a business.

SC = (E + R + I + M + A + L)

Variables:

- SC is the total startup cost ($)

- E is the cost of equipment ($)

- R is the cost of rent for premises ($)

- I is the cost of initial inventory ($)

- M is the marketing expenses ($)

- A is the administrative and legal expenses ($)

- L is the cost of licenses and permits ($)

To calculate the total startup cost, add up the cost of equipment, rent for premises, initial inventory, marketing expenses, administrative and legal expenses, and the cost of licenses and permits.

What is a Startup Cost?

Startup cost refers to the initial expenses incurred when setting up a new business. These costs can include expenses for market research, legal fees, licensing, inventory, property leases or purchases, branding, advertising, salaries for initial employees, and any other costs associated with the creation and initial operation of a new business. The amount of startup costs can vary greatly depending on the type and size of the business.

How to Calculate Startup Cost?

The following steps outline how to calculate the Startup Cost using the formula: SC = (E + R + I + M + A + L).

- First, determine the cost of equipment ($).

- Next, determine the cost of rent for premises ($).

- Next, determine the cost of initial inventory ($).

- Next, determine the marketing expenses ($).

- Next, determine the administrative and legal expenses ($).

- Finally, determine the cost of licenses and permits ($).

- After obtaining the values for each variable, use the formula SC = (E + R + I + M + A + L) to calculate the total startup cost ($).

Example Problem:

Use the following variables as an example problem to test your knowledge.

cost of equipment ($) = 5000

cost of rent for premises ($) = 2000

cost of initial inventory ($) = 1000

marketing expenses ($) = 1500

administrative and legal expenses ($) = 800

cost of licenses and permits ($) = 300