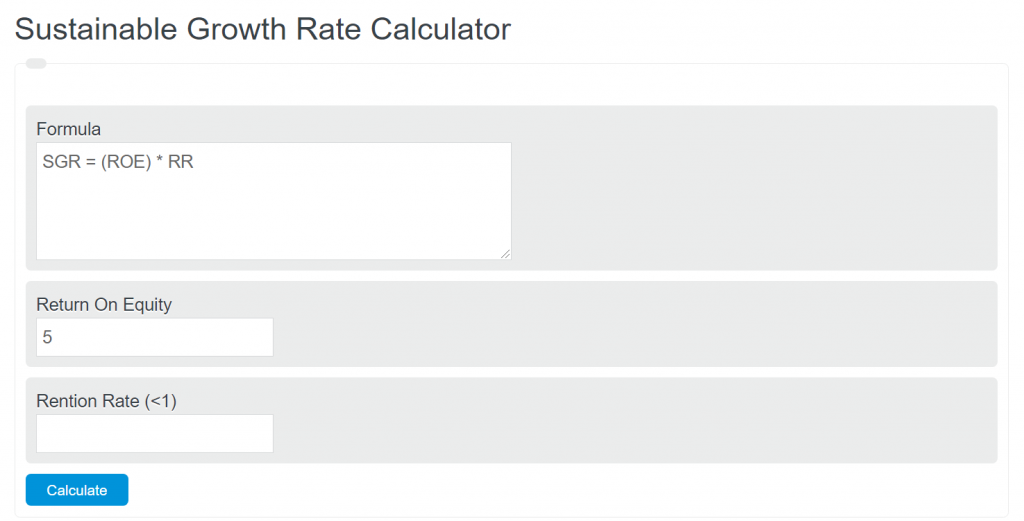

Enter the return on equity (ROE) and the retention rate into the calculator to determine the sustainable growth rate. The retention rate is equal to 1 minus the dividend payout ratio.

- Dividend Growth Calculator

- CAGR Calculator (Compound Annual Growth Rate%)

- Exponential Growth Calculator

- Internal Growth Rate Calculator

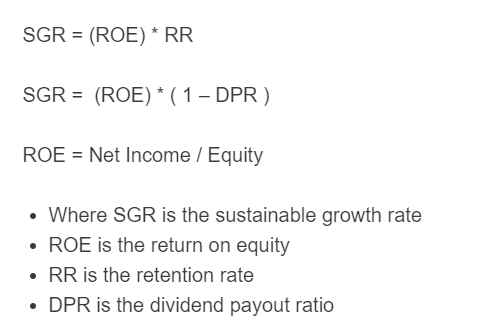

Sustainable Growth Rate Formula

The following equations are used to calculator the sustainable growth rate of a company.

SGR = (ROE) * RR

SGR = (ROE) * ( 1 – DPR )

- Where SGR is the sustainable growth rate

- ROE is the return on equity

- RR is the retention rate

- DPR is the dividend payout ratio

Return on equity is a financial metric that measures the profitability of a company by calculating the amount of net income generated as a percentage of shareholders’ equity.

Retention Ratio represents the proportion of earnings the company retains to finance growth instead of being distributed as dividends.

The dividend payout ratio is a financial metric that measures the proportion of a company’s earnings distributed to shareholders as dividends.

Sustainable Growth Rate (Finance) Definition

Sustainable Growth Rate (SGR) in finance refers to the maximum rate at which a company can grow its sales, earnings, and dividends without relying on external financing or sacrificing its financial stability. It is a crucial metric for evaluating a company’s long-term viability and financial health.

Understanding SGR is important because it indicates the sustainable pace at which a company can expand its operations while maintaining financial equilibrium.

If a company grows too rapidly, it may face financial instability due to increased debt or inadequate cash flows. On the other hand, if a company grows too slowly, it might miss out on potential opportunities and lose market share.

By analyzing the SGR, investors and analysts can assess a company’s growth prospects and make informed investment decisions.

If a company has a high SGR, it suggests that it can generate sufficient internal funds to support its growth plans, which is generally considered positive.

Conversely, a low SGR may indicate limited growth potential or the need for external financing, which may increase the company’s financial risks.

Sustainable Growth Rate Example

How to calculate a sustainable growth rate?

- First, determine the return on equity.

Calculate the total return on equity the company achieves on average.

- Next, determine the retention rate.

Calculate or determine the total retention rate.

- Finally, calculate the sustainable growth rate.

Use the formula above to calculate the sustainable growth rate.

FAQ

What factors influence the Return on Equity (ROE)?Several factors can influence ROE, including profit margins, asset turnover, and financial leverage. A company’s operational efficiency, cost management, and debt levels can significantly impact its ROE.

Why is the retention rate important for a company’s growth?The retention rate is crucial because it indicates the percentage of earnings a company reinvests in itself rather than distributing as dividends. A higher retention rate usually means more funds are available for growth investments, research and development, and expanding operations.

Can a company have a negative sustainable growth rate?Yes, a company can have a negative sustainable growth rate if it has a negative return on equity (ROE) or if it distributes more dividends than its net income, resulting in a negative retention rate. This situation indicates that the company might be shrinking or losing value over time.

How does external financing affect a company’s sustainable growth rate?External financing can temporarily boost a company’s growth beyond its sustainable growth rate by providing additional funds for investment. However, relying too much on external financing can increase debt levels and financial risk, potentially leading to financial instability if not managed properly.