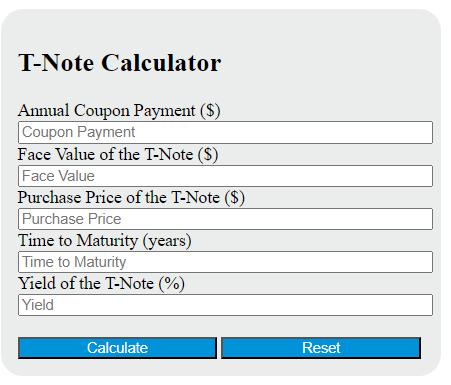

Enter the annual coupon payment, face value of the t-note, purchase price, and time to maturity to calculate the yield of the t-note.

- Yield Maintenance Calculator

- Bond Equivalent Yield Calculator (+ Formula)

- Taxable Equivalent Yield Calculator

T Note Formula

The following formula is used to calculate the yield of a T-Note (Treasury Note).

Y = (C + ((F - P) / t)) / ((F + P) / 2)

Variables:

- Y is the yield of the T-Note (%)

- C is the annual coupon payment ($)

- F is the face value of the T-Note ($)

- P is the purchase price of the T-Note ($)

- t is the time to maturity (years)

To calculate the yield of a T-Note, add the annual coupon payment to the difference between the face value and the purchase price, divided by the time to maturity. Divide this result by the average of the face value and the purchase price.

What is a T Note?

A T Note, or Treasury Note, is a type of U.S. government debt security that is issued with a maturity period of between two and ten years. These notes are backed by the U.S. government, making them a relatively low-risk investment. They pay interest to the holder every six months until maturity, at which point the face value of the note is paid to the holder. The interest rate is determined at auction.

How to Calculate T Note?

The following steps outline how to calculate the yield of a T-Note using the given formula:

- First, determine the annual coupon payment (C) in dollars.

- Next, determine the face value of the T-Note (F) in dollars.

- Next, determine the purchase price of the T-Note (P) in dollars.

- Next, determine the time to maturity (t) in years.

- Next, substitute the values of C, F, P, and t into the formula: Y = (C + ((F – P) / t)) / ((F + P) / 2).

- Finally, calculate the yield of the T-Note (Y) as a percentage.

Example Problem:

Use the following variables as an example problem to test your knowledge:

Annual coupon payment (C) = $500

Face value of the T-Note (F) = $10,000

Purchase price of the T-Note (P) = $9,800

Time to maturity (t) = 5 years