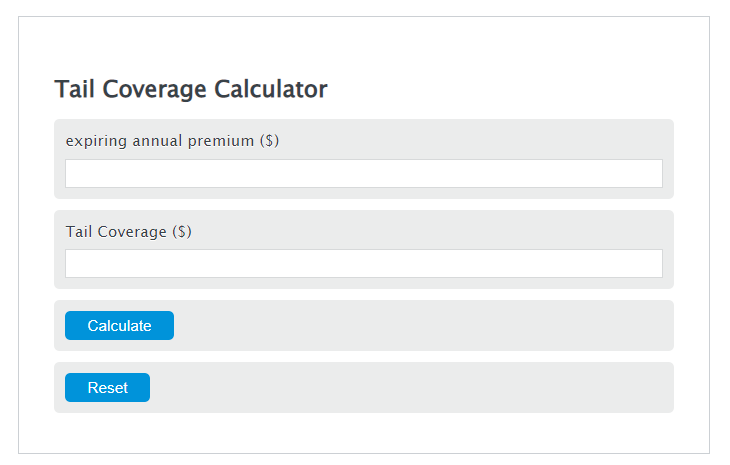

Enter the expiring annual premium ($) into the Calculator. The calculator will evaluate the Tail Coverage.

- Default Risk Premium Calculator

- Health Insurance Cost Per Month Calculator

- Life Insurance Cost Per Month Calculator

Tail Coverage Formula

TC = EP * 2

Variables:

- TC is the Tail Coverage ($)

- EP is the expiring annual premium ($)

To calculate Tail Coverage, multiply the expiring annual premium by 2.

How to Calculate Tail Coverage?

The following steps outline how to calculate the Tail Coverage.

- First, determine the expiring annual premium ($).

- Next, gather the formula from above = TC = EP * 2.

- Finally, calculate the Tail Coverage.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

expiring annual premium ($) = 2000

FAQs about Tail Coverage

What is Tail Coverage in insurance?

Tail Coverage, also known as Extended Reporting Period Endorsement, is a feature in liability insurance policies that allows the insured to report claims for incidents that occurred while the policy was active but were reported after the policy has expired.

Why is Tail Coverage important?

Tail Coverage is important because it protects the insured against claims that are made after a policy expires. This is particularly relevant in professions where there might be a delay between the occurrence of an incident and the filing of a claim.

How is the cost of Tail Coverage calculated?

The cost of Tail Coverage is typically calculated as a multiple of the expiring annual premium. The exact multiplier can vary depending on the policy, the insurer, and the specific terms of coverage.

Can Tail Coverage be purchased at any time?

Typically, Tail Coverage needs to be purchased either at the time the original policy is bought or when it is renewed. Some insurers may allow the purchase of Tail Coverage at the time of policy cancellation, but this is not always the case.