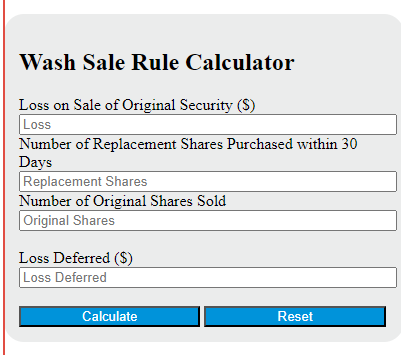

Enter the loss on the sale of the original security and the ratio of the number of replacement shares purchased within 30 days to the number of original shares sold into the calculator to determine the loss deferred.

Wash Sale Rule Formula

The following formula is used to calculate the potential loss deferred due to the Wash Sale Rule.

LD = L * (RS / OS)

Variables:

- LD is the loss deferred ($)

- L is the loss on the sale of the original security ($)

- RS is the number of replacement shares purchased within 30 days

- OS is the number of original shares sold

To calculate the potential loss deferred due to the Wash Sale Rule, multiply the loss on the sale of the original security by the ratio of the number of replacement shares purchased within 30 days to the number of original shares sold.

What is a Wash Sale Rule?

The Wash Sale Rule is a regulation set by the Internal Revenue Service (IRS) that prohibits a taxpayer from claiming a loss on the sale or trade of a security if the same security is repurchased within 30 days before or after the sale. This rule is designed to prevent investors from selling securities at a loss simply to claim a tax benefit. A wash sale results in the loss being deferred until the replacement shares are sold.

How to Calculate Wash Sale Rule?

The following steps outline how to calculate the Wash Sale Rule using the formula: LD = L * (RS / OS).

- First, determine the loss on the sale of the original security ($), denoted as L.

- Next, determine the number of replacement shares purchased within 30 days, denoted as RS.

- Next, determine the number of original shares sold, denoted as OS.

- Next, calculate the loss deferred ($), denoted as LD, using the formula LD = L * (RS / OS).

- Finally, calculate the Wash Sale Rule.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

loss on the sale of the original security ($) = 500

number of replacement shares purchased within 30 days = 100

number of original shares sold = 50