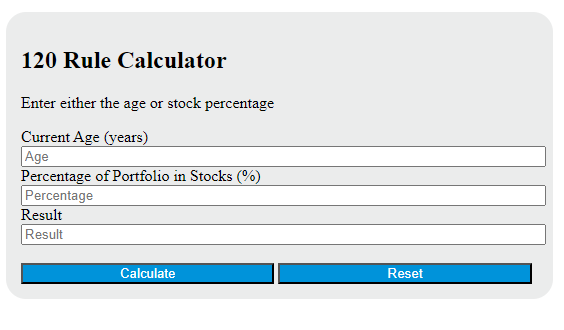

Enter your current age and desired stock allocation into the calculator to determine the percentage of your portfolio that should be invested in stocks according to the 120 Rule.

- 3 Percent Rule Retirement Calculator

- Portfolio Sector Allocation Calculator

- Portfolio Diversity Calculator

120 Rule Formula

The following formula is used to calculate the percentage of your investment portfolio that should be allocated to stocks according to the 120 Rule.

S = 120 - A

Variables:

- S is the percentage of your portfolio that should be invested in stocks (%)

- A is your current age (years)

To calculate the percentage of your portfolio that should be invested in stocks, subtract your current age from 120. The result is the percentage of your portfolio that should be invested in stocks according to the 120 Rule. The remaining percentage (100 – S) should be invested in bonds or other less risky investments.

What is a 120 Rule?

The 120 Rule is a retirement planning concept that suggests the percentage of your investment portfolio that should be allocated to stocks is 120 minus your age. This rule is designed to help individuals rebalance their portfolios to manage risk as they age. For example, if you are 40 years old, the rule suggests that 80% (120-40) of your portfolio should be invested in stocks, with the remaining 20% in bonds or other less risky investments.

How to Calculate 120 Rule?

The following steps outline how to calculate the 120 Rule.

- First, determine your current age (A) in years.

- Next, subtract your current age (A) from 120 to get the percentage of your portfolio that should be invested in stocks (S).

- Finally, calculate the 120 Rule by using the formula: S = 120 – A.

- After inserting the value of your current age (A) into the formula, calculate the result.

- Check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Current age (A) = 35 years

Percentage of portfolio in stocks (S) = 120 – 35 = 85%