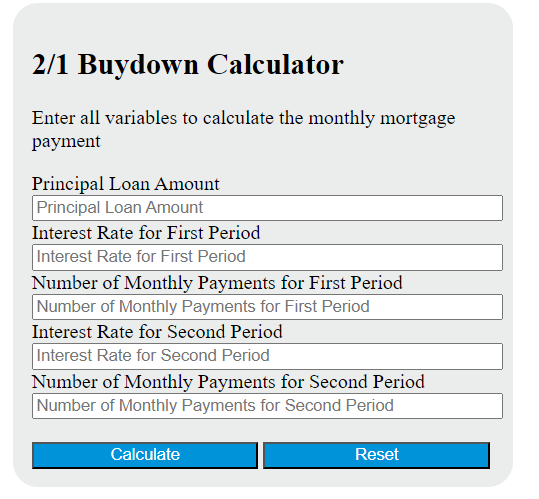

Enter the principal loan amount, interest rates for the first and second periods, and the number of monthly payments for each period into the calculator to determine the monthly mortgage payment for a 2/1 buydown.

- Mcc (Mortgage Credit Certificate) Calculator

- Mortgage Service Ratio Calculator

- Mortgage to Income Ratio Calculator

2/1 Buydown Formula

The following formula is used to calculate the monthly mortgage payment for a 2/1 buydown:

MP = (P * r1 * (1 + r1)^n1 + P * r2 * (1 + r2)^n2) / ((1 + r1)^n1 + (1 + r2)^n2 – 1)

Variables:

- MP is the monthly mortgage payment

- P is the principal loan amount

- r1 is the interest rate for the first period

- n1 is the number of monthly payments for the first period

- r2 is the interest rate for the second period

- n2 is the number of monthly payments for the second period

What is a 2/1 Buydown?

A 2/1 Buydown is a type of mortgage loan program where the borrower’s interest rate is reduced for the first two years of the loan term. This is achieved by the borrower or the home seller paying an upfront fee, or “buydown,” to the lender at the time of closing. The interest rate is reduced by 2% in the first year and 1% in the second year, hence the name 2/1 Buydown. After the initial two years, the interest rate adjusts to the agreed-upon rate for the remainder of the loan term. This type of loan can be beneficial for borrowers who expect their income to increase in the future, as it allows for lower payments in the early years of the mortgage.

How to Calculate 2/1 Buydown?

The following steps outline how to calculate the 2/1 Buydown.

- First, determine the original interest rate (%).

- Next, calculate the reduced interest rate for the first year by subtracting 2% from the original interest rate.

- Next, calculate the reduced interest rate for the second year by subtracting 1% from the original interest rate.

- Finally, compare the monthly mortgage payment for the original interest rate with the monthly mortgage payment for the reduced interest rate in the first and second years.

- After calculating the monthly mortgage payments, compare the savings in the first and second years to determine the total savings over the two-year period.

Example Problem :

Use the following variables as an example problem to test your knowledge.

original interest rate (%) = 4.5

monthly mortgage payment for original interest rate ($) = 1500

monthly mortgage payment for reduced interest rate in the first year ($) = 1400

monthly mortgage payment for reduced interest rate in the second year ($) = 1450