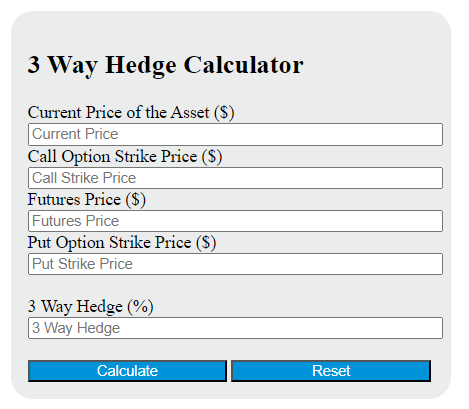

Enter the price of the asset, call option strike price, futures price, and put option strike price to determine the 3-way hedge.

What is a 3-Way Hedge?

A 3-way hedge is a risk management strategy used in commodity trading, particularly in the oil and gas industry. It involves the use of futures contracts and options to protect against price fluctuations. The strategy consists of three parts: a long put option to set a floor price, a short put option to offset the cost of the long put, and a short call option to set a ceiling price. This allows the trader to limit their exposure to price volatility, securing a price range within which they can profit, but also limiting potential gains if prices move beyond this range.

How to Calculate 3 Way Hedge?

The following steps outline how to calculate the 3 Way Hedge.

- First, determine the current price of the asset (P) ($).

- Next, determine the call option strike price (C) ($).

- Next, determine the futures price (F) ($).

- Next, determine the put option strike price (M) ($).

- Next, gather the formula from above = 3WH = (P * (C – F) + (F – P) * (P <= F) + (P – M) * (P > M)) / P.

- Finally, calculate the 3 Way Hedge.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

current price of the asset (P) ($) = 50

call option strike price (C) ($) = 60

futures price (F) ($) = 55

put option strike price (M) ($) = 45