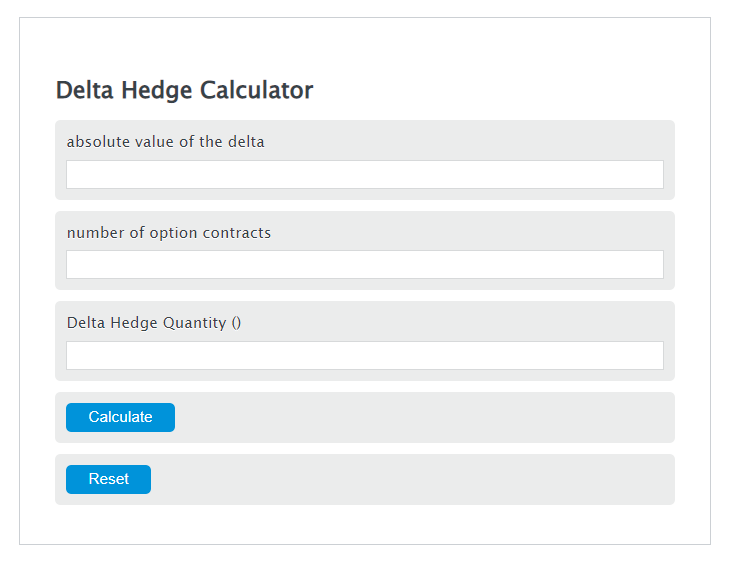

Enter the absolute value of the delta and the number of option contracts into the Calculator. The calculator will evaluate the Delta Hedge Quantity.

Delta Hedge Quantity Formula

DH = AVD * O * 100

Variables:

- DH is the Delta Hedge Quantity ()

- AVD is the absolute value of the delta

- O is the number of option contracts

To calculate Delta Hedge Quantity, multiply the absolute value of the delta by the number of option contracts, then multiply by 100.

How to Calculate Delta Hedge Quantity?

The following steps outline how to calculate the Delta Hedge Quantity.

- First, determine the absolute value of the delta.

- Next, determine the number of option contracts.

- Next, gather the formula from above = DH = AVD * #O * 100.

- Finally, calculate the Delta Hedge Quantity.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

absolute value of the delta = 4.25

number of option contracts = 300

FAQs

What is delta in options trading?

Delta represents the rate of change between the option’s price and a $1 change in the underlying asset’s price. In essence, it measures the price sensitivity of an option relative to the underlying asset.

Why is hedging important in options trading?

Hedging is a strategy used to limit or offset the probability of loss from fluctuations in the prices of currencies, commodities, or securities. In options trading, it helps manage risk by providing a form of insurance against price movements.

Can delta be negative?

Yes, delta can be negative. For put options, delta is typically negative, reflecting the fact that the option’s price will likely decrease if the underlying asset’s price increases.

How does the number of option contracts affect the Delta Hedge Quantity?

The number of option contracts directly influences the Delta Hedge Quantity. Increasing the number of contracts will proportionally increase the hedge quantity, as the formula for Delta Hedge Quantity is directly multiplied by the number of option contracts.