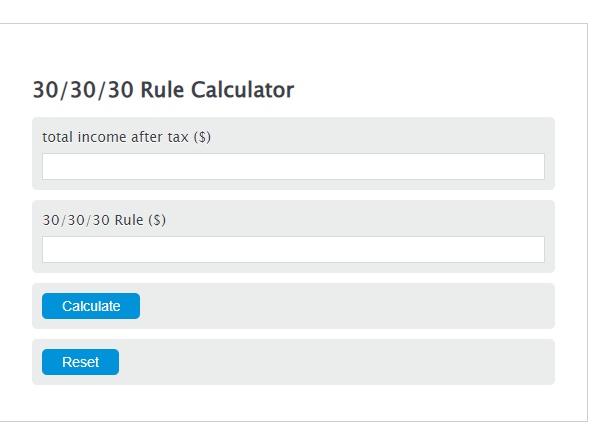

Enter the total income after tax ($) into the Calculator. The calculator will evaluate the 30/30/30 Rule.

30/30/30 Rule Formula

B = ATI * .30

Variables:

- B is the 30/30/30 Rule ($)

- ATI is the total income after tax ($)

To calculate 30/30/30 Rule, simply multiply the income after tax by .30, and the result is what you should use for each of the 30/30/30 budgets.

How to Calculate 30/30/30 Rule?

The following steps outline how to calculate the 30/30/30 Rule.

- First, determine the total income after tax ($).

- Next, gather the formula from above = B = ATI * .30.

- Finally, calculate the 30/30/30 Rule.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total income after tax ($) = 30000

Frequently Asked Questions (FAQ)

What is the 30/30/30 Rule and how does it help in budgeting?

The 30/30/30 Rule is a budgeting principle that suggests dividing your after-tax income into three equal parts of 30% each, for spending, saving, and investing or paying off debt. This approach helps in creating a balanced financial plan that covers immediate expenses, future savings, and investments or debt reduction.

How does the 30/30/30 Rule compare to the 50/30/20 budgeting rule?

While the 30/30/30 Rule divides after-tax income into three equal parts, the 50/30/20 rule allocates 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. The 30/30/30 Rule focuses more on equal distribution for spending, saving, and investing or debt repayment, potentially offering a more balanced approach for some individuals.

Can the 30/30/30 Rule be adjusted based on personal financial goals?

Yes, the 30/30/30 Rule can be adjusted to better fit individual financial situations and goals. For instance, if someone has higher debt, they might choose to allocate more towards debt repayment than investing or saving. The key is to maintain a balanced approach that supports financial health and goals.

Is the 30/30/30 Rule suitable for everyone?

No budgeting rule is one-size-fits-all, and the 30/30/30 Rule is no exception. It’s a guideline that can be modified to suit different incomes, lifestyles, and financial objectives. Individuals should consider their unique financial situation and possibly consult with a financial advisor to tailor a budgeting strategy that works best for them.