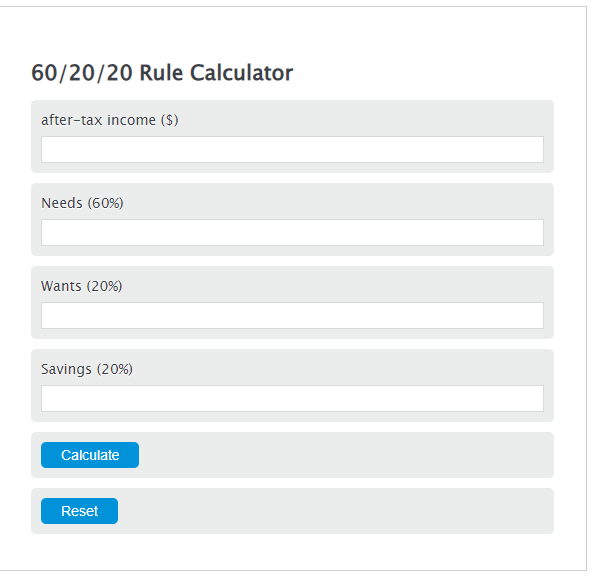

Enter the income after tax ($) and the rule rate into the Calculator. The calculator will evaluate the 60/20/20 Rule.

60/20/20 Rule Formula

B = I * RR

Variables:

- B is the 60/20/20 Rule ($)

- I is the income after tax ($)

- RR is the rule rate

To calculate 60/20/20 Rule, multiply the after tax income by the rule rate.

How to Calculate 60/20/20 Rule?

The following steps outline how to calculate the 60/20/20 Rule.

- First, determine the income after tax ($).

- Next, determine the rule rate.

- Next, gather the formula from above = B = I * RR.

- Finally, calculate the 60/20/20 Rule.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

income after tax ($) = 5000

rule rate = 0.6

FAQs about the 60/20/20 Rule

What is the 60/20/20 budgeting rule?

The 60/20/20 rule is a budgeting guideline that suggests allocating 60% of your after-tax income to needs, 20% to savings, and the remaining 20% to wants. This rule is designed to help individuals manage their finances more effectively by providing a simple framework for budget allocation.

How can the 60/20/20 rule help in financial planning?

By following the 60/20/20 rule, individuals can ensure that a significant portion of their income is dedicated to essential expenses while still allowing for savings and discretionary spending. This balance can help in achieving financial goals, such as building an emergency fund, saving for retirement, or paying off debt, while also enjoying life’s pleasures.

Can the 60/20/20 rule be adjusted based on personal financial situations?

Yes, the 60/20/20 rule is flexible and can be adjusted based on individual financial situations and goals. For instance, if someone has a higher income or fewer needs, they might choose to allocate more towards savings. Conversely, those with higher debt levels might adjust the rule to contribute more towards debt repayment.