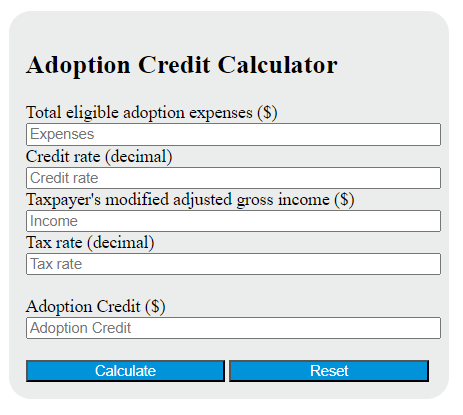

Enter the total eligible adoption expenses and the credit rate, as well as the taxpayer’s modified adjusted gross income and the tax rate into the calculator to determine the Adoption Credit.

Adoption Credit Formula

The following formula is used to calculate the Adoption Credit.

AC = (E * r) - (I * t)

Variables:

- AC is the Adoption Credit ($)

- E is the total eligible adoption expenses ($)

- r is the credit rate (decimal)

- I is the taxpayer’s modified adjusted gross income ($)

- t is the tax rate (decimal)

To calculate the Adoption Credit, multiply the total eligible adoption expenses by the credit rate. Then, multiply the taxpayer’s modified adjusted gross income by the tax rate. Subtract the second result from the first to get the Adoption Credit.

What is a Adoption Credit?

The Adoption Credit is a non-refundable tax credit offered by the U.S. federal government to help offset the costs of adoption. It is designed to help families cover expenses such as adoption fees, court costs, attorney fees, traveling expenses, and other direct costs associated with legal adoption. The amount of the credit may vary each year and is subject to income limitations, which could reduce or eliminate the amount for some families.

How to Calculate Adoption Credit?

The following steps outline how to calculate the Adoption Credit:

- First, determine the total eligible adoption expenses ($).

- Next, determine the credit rate (decimal).

- Next, determine the taxpayer’s modified adjusted gross income ($).

- Next, determine the tax rate (decimal).

- Next, gather the formula from above = AC = (E * r) – (I * t).

- Finally, calculate the Adoption Credit.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Total eligible adoption expenses ($) = 5000

Credit rate (decimal) = 0.2

Taxpayer’s modified adjusted gross income ($) = 60000

Tax rate (decimal) = 0.25