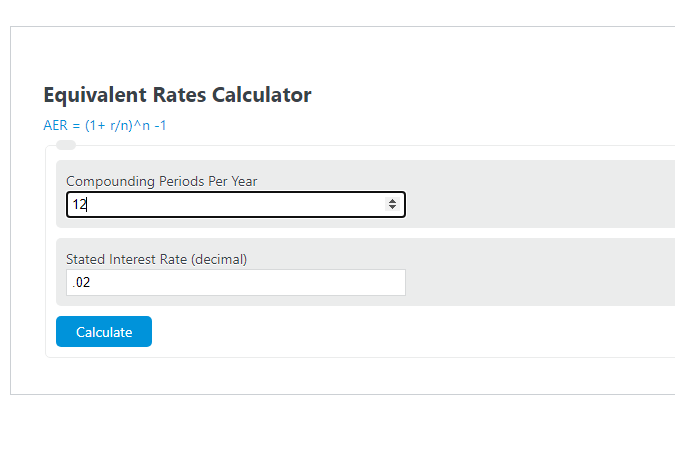

Enter the number of compounding periods and the stated interest rate into the calculator to determine the annual equivalent rate.

- Effective Interest Rate Calculator

- Real Interest Rate Calculator

- Effective Annual Yield Calculator

- CAGR Calculator (Compound Annual Growth Rate%)

- FTE (Full-Time-Equivalent) Calculator

Annual Equivalent Rates Formula

The following formula is used to calculate the annual equivalent interest rate.

AER = (1+ r/n)^n -1

- Where AER is the annual equivalent rates

- r is the stated interest rate

- n is the number of compounding periods per year

Equivalent Rates Definition

An equivalent rate, commonly described in terms of an annual basis, is the equivalent interest that an investor earns on an investment due to compounding.

For example, if an investment is pays out interest on a monthly basis, then the AER would be the total equivalent return rate for the entire year.

Example Problem

How to calculate equivalent rates?

- First, determine the number of compounding periods per year (or given time period).

For this example, we will look at an investment that pays out interest on a monthly basis.

- Next, determine the interest or return rate per period.

In this case, the investment rate is 2% for the year, paid monthly.

- Finally, calculate the equivalent rates for the year.

Using the formula (1+ r/n)n -1, calculate the annual equivalent rate. AER = (1+(.02/12))12 -1 = .02018 = 2.018%.