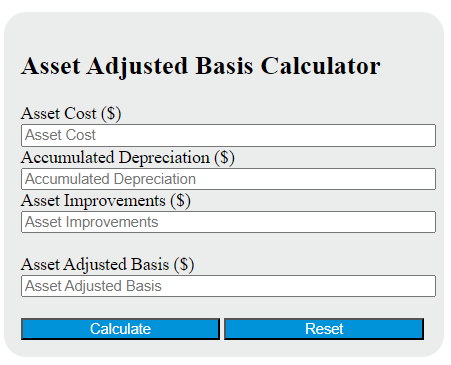

Enter the Asset Cost, Accumulated Depreciation, and Asset Improvements into the calculator to determine the Asset Adjusted Basis.

Asset Adjusted Basis Formula

The following formula is used to calculate the Asset Adjusted Basis.

AAB = AC - AD + AI

Variables:

- AAB is the Asset Adjusted Basis ($)

- AC is the Asset Cost ($)

- AD is the Accumulated Depreciation ($)

- AI is the Asset Improvements ($)

To calculate the Asset Adjusted Basis, subtract the Accumulated Depreciation from the Asset Cost, then add the Asset Improvements to the result. This will give you the Asset Adjusted Basis.

What is an Asset Adjusted Basis?

Asset Adjusted Basis refers to the original cost of an asset, including any improvements made to it, adjusted for factors such as depreciation or amortization. This value is used to calculate the taxable gain or loss when the asset is sold. Essentially, it is the starting point for determining the profit or loss from the sale or disposition of an asset.

How to Calculate Asset Adjusted Basis?

The following steps outline how to calculate the Asset Adjusted Basis.

- First, determine the Asset Cost ($).

- Next, determine the Accumulated Depreciation ($).

- Next, determine the Asset Improvements ($).

- Next, gather the formula from above = AAB = AC – AD + AI.

- Finally, calculate the Asset Adjusted Basis.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Asset Cost ($) = 5000

Accumulated Depreciation ($) = 2000

Asset Improvements ($) = 1000