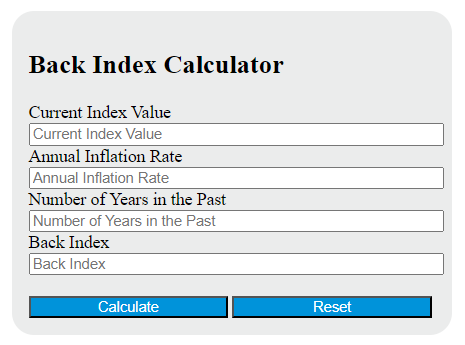

Enter the Current Index value, annual inflation rate, and the number of years into the calculator to determine the Back Index.

Back Index Formula

The following formula is used to calculate the Back Index.

BI = (CI / (1 + r)^n)

Variables:

- BI is the Back Index

- CI is the Current Index value

- r is the annual inflation rate

- n is the number of years in the past

To calculate the Back Index, divide the Current Index value by the result of adding 1 to the annual inflation rate, raised to the power of the number of years in the past.

What is a Back Index?

A Back Index is a financial tool that recreates the performance of a particular index over a specific period in the past. It is used to analyze historical trends and performance of an index, which can help investors make informed decisions. Back indexes are often used in backtesting investment strategies to see how they would have performed under past market conditions.

How to Calculate Back Index?

The following steps outline how to calculate the Back Index using the formula: BI = (CI / (1 + r)^n).

- First, determine the current index value (CI).

- Next, determine the annual inflation rate (r).

- Next, determine the number of years in the past (n).

- Next, calculate (1 + r)^n.

- Finally, calculate the Back Index (BI) using the formula BI = (CI / (1 + r)^n).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Current Index value (CI) = 120

Annual inflation rate (r) = 0.03

Number of years in the past (n) = 5