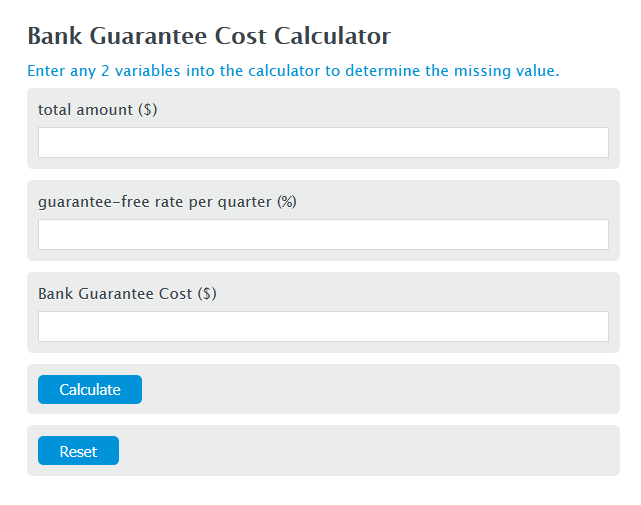

Enter the total amount ($) and the guarantee free rate per quarter (%) into the Calculator. The calculator will evaluate the Bank Guarantee Cost.

Bank Guarantee Cost Formula

BGC = TA * QF/100

Variables:

- BGC is the Bank Guarantee Cost ($)

- TA is the total amount ($)

- QF is the guarantee-free rate per quarter (%)

To calculate the Bank Guarantee Cost, multiply the total amount by the guarantee-free rate.

How to Calculate Bank Guarantee Cost?

The following steps outline how to calculate the Bank Guarantee Cost.

- First, determine the total amount ($).

- Next, determine the guarantee free rate per quarter (%).

- Next, gather the formula from above = BGC = TA * QF/100.

- Finally, calculate the Bank Guarantee Cost.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total amount ($) = 1000000

guarantee free rate per quarter (%) = 2.5

Frequently Asked Questions (FAQ)

What is a Bank Guarantee?

A bank guarantee is a promise from a banking institution that ensures the debtor will meet their obligations to a third party. If the debtor fails to fulfill their commitments, the bank will cover the full or remaining amount owed.

Why are Bank Guarantees important in business transactions?

Bank guarantees play a crucial role in business transactions by mitigating risk for the beneficiary. They assure that the financial obligations will be met, making it safer for businesses to engage in deals and projects with a reduced risk of financial loss.

Can the Bank Guarantee Cost vary over time?

Yes, the cost of a bank guarantee can vary depending on several factors, including the creditworthiness of the applicant, the amount of the guarantee, the duration of the guarantee, and the prevailing interest rates.

Are there different types of Bank Guarantees?

Yes, there are several types of bank guarantees, including performance guarantees, financial guarantees, bid bond guarantees, advance payment guarantees, and warranty guarantees. Each type serves a specific purpose in supporting contractual obligations.