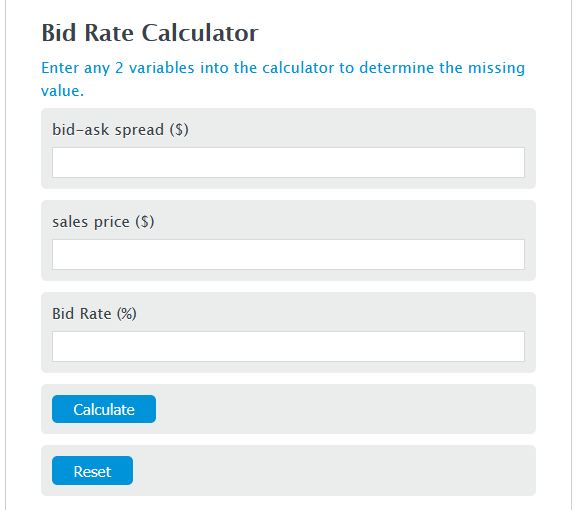

Enter the bid-ask spread ($) and the sales price ($) into the Calculator. The calculator will evaluate the Bid Rate.

Bid Rate Formula

BR = BAS / SP * 100

Variables:

- BR is the Bid Rate (%)

- BAS is the bid-ask spread ($)

- SP is the sales price ($)

To calculate Bid Rate, divide the bid-ask spread by the sales price, then multiply by 100.

How to Calculate Bid Rate?

The following steps outline how to calculate the Bid Rate.

- First, determine the bid-ask spread ($).

- Next, determine the sales price ($).

- Next, gather the formula from above = BR = BAS / SP * 100.

- Finally, calculate the Bid Rate.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

bid-ask spread ($) = 3

sales price ($) = 100

FAQs

What is the significance of the Bid Rate in financial markets?

The Bid Rate is crucial in financial markets as it helps investors understand the demand for a security. A higher Bid Rate indicates a higher demand, which can be a sign of a more attractive investment opportunity. It also reflects the liquidity of the asset, as a narrow bid-ask spread usually signifies a more liquid market.

How does the bid-ask spread affect the Bid Rate?

The bid-ask spread directly impacts the Bid Rate; a wider spread indicates a higher cost to trade, reducing the Bid Rate. Conversely, a narrower spread suggests lower trading costs, potentially increasing the Bid Rate. This spread is essential for traders and investors in evaluating the cost-effectiveness of entering or exiting positions.

Can the Bid Rate formula be applied to any financial asset?

Yes, the Bid Rate formula (BR = BAS / SP * 100) can be applied to any financial asset with a discernible bid-ask spread and sales price, including stocks, bonds, currencies, and commodities. However, the relevance and implications of the Bid Rate might vary across different asset classes.

Why is it important to calculate the Bid Rate?

Calculating the Bid Rate is important for several reasons. It helps traders and investors gauge the market’s liquidity and competitiveness. A lower Bid Rate could indicate a less liquid market or higher trading costs, which could impact investment decisions. Additionally, understanding the Bid Rate can help in better negotiation of prices and in the strategic timing of market entry or exit.