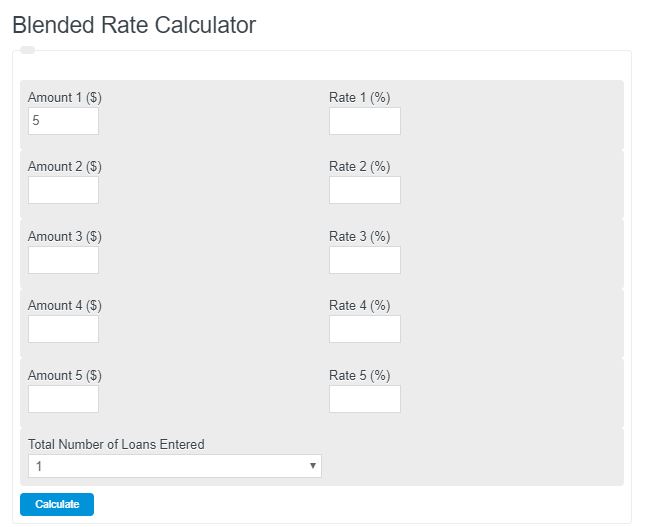

Enter up to 5 different loan or mortgage amounts and their current interest rates. The blended rate calculator will display the blended interest rate of all of the amounts.

- Mortgage Calculator

- Home Affordability Calculator

- Commercial Lease Calculator

- Rent Increase Calculator

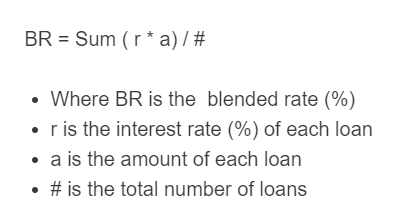

Blended Rate Formula

The following formula is used to calculate a blended rate from a series of different loan amounts and interest.

BR = Sum ( r * a) / L / Avg (a)

- Where BR is the blended rate (%)

- r is the interest rate (%) of each loan

- a is the amount of each loan

- L is the total number of loans

- Avg (a) is the average of the loan amounts

To calculate the blended rate, sum the interest rate times the loan amount of each loan, then divide by the total number of loans, and finally divide by the average loan amount.

Blended Rate Definition

A blended rate is defined as the weighted average of the rates of a set of varying loans.

Blended Rate Example

How to calculate a blended rate?

- First, gather all of the interest rates and loan amounts

Calculate or determine the amount of each loan and the % interest rate.

- Next, multiply the interest rates by the loan amounts

For each loan, multiply the total amount by the % rate. Keep each calculated number separate.

- Sum the values from step 2

Add up all of the values calculated in step 2.

- Calculate the blended rate

Finally, divide the sum of the values calculated in step 3 by the total number of loans.

FAQ

A blended rate is a term used in finance used to describe the weighted average of a set of different loan rates. It takes into account the total values of the loans so that the blended rate is the effective rate of all loans together.

No, blended rates are weight by their total loan amounts. For example, if you had two loan amounts and rates, say 10,000 at 5% and 1,000 at 1%, the blended rate would be weighted towards 5% at 10 times the weight of 1%. In short, the blended rate would be more than 4.5%.