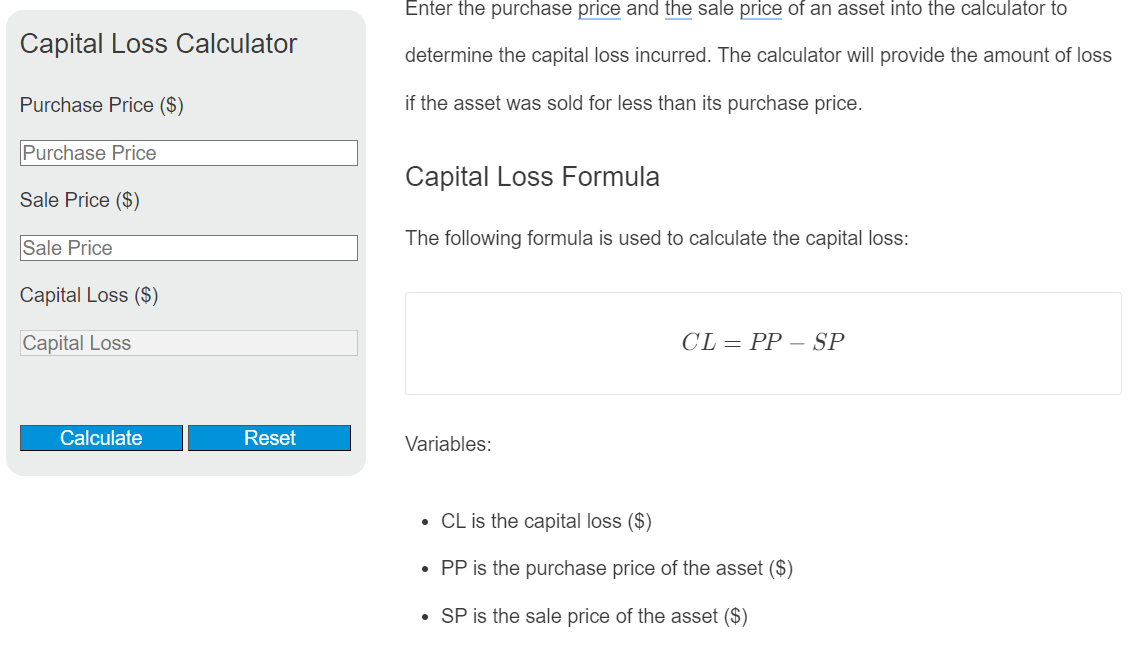

Enter the purchase price and the sale price of an asset into the calculator to determine the capital loss incurred. The calculator will provide the amount of loss if the asset was sold for less than its purchase price.

- CAPM (Capital Asset Pricing Model) Calculator

- Capital Charge Factor Calculator

- Capitalization of Earnings Method Calculator

Capital Loss Formula

The following formula is used to calculate the capital loss:

CL = PP - SP

Variables:

- CL is the capital loss ($)

- PP is the purchase price of the asset ($)

- SP is the sale price of the asset ($)

To calculate the capital loss, subtract the sale price from the purchase price of the asset. If the result is negative, it means there is no capital loss.

What is a Capital Loss?

A capital loss occurs when the sale price of an asset is less than its purchase price. It represents a decrease in the value of an investment and can be used to offset capital gains for tax purposes. Capital losses are important considerations in investment strategies and tax planning.

How to Calculate Capital Loss?

The following steps outline how to calculate the Capital Loss:

- First, determine the purchase price of the asset (PP).

- Next, determine the sale price of the asset (SP).

- Use the formula CL = PP – SP to calculate the capital loss.

- If the result is positive, that is the capital loss. If the result is negative or zero, there is no capital loss.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Purchase price of the asset (PP) = $5000

Sale price of the asset (SP) = $4000